For over four decades, the pulse of the robust Chinese economy lay within its thriving real estate market. Property in China was the world’s largest asset class, with an estimated peak value of $60 trillion. The country’s economic prowess, fuelled by its insatiable appetite for construction and development, extended the reach of its influence beyond the domestic market and into the global economy. However, after being hailed as a major driver of the country’s economic expansion, the Chinese economy is currently at a critical crossroads with at least a billion units left to gather dust, hundreds of billions in homebuilder debt, and trillions of dollars in local government debt.

The collapse of more than 40 percent of major Chinese property developers since mid-2021 – representing approximately one-quarter of China’s GDP – highlights the deepening crisis in the real estate sector. At the forefront of this spiralling crisis are two of the largest Chinese real estate developers: Evergrande and Country Garden. Evergrande’s initial default marked a seismic shift, propelling it to the dubious claim of the world’s most indebted property developer with $340 billion in liabilities. Its collapse in 2021 triggered a domino effect pulling down China’s real estate market. Country Garden, long thought to be more stable, followed suit after failing to meet payments on offshore bonds. Beijing, however, has controversially refrained from direct intervention, adopting a ‘tough love’ approach.

In theory, a country’s gross domestic product (GDP) is composed of four parts: consumption, investments, government spending, and net exports. China, being one of the biggest economies globally, prioritize the investment component of GDP as its main facilitator of growth. This is mainly driven by its massive real estate market, which constitutes for roughly 25-30% of China’s GDP. As a result, the current Chinese property crisis, which has already seen the collapse of major industry titans, threatens to impact almost a third of the Chinese economy.

The Chinese property crisis was the result of many factors, chief of which was the government’s use of infrastructure projects to drive rapid GDP growth. This likely results from the provision of incentives to local governments to boost GDP through investments. Local governments were banned from borrowing money from the central government, leading many to rely on local government financing vehicles (LGFVs), which raised debt to fund projects. This has led to local governments ballooning in debt owed to Chinese banks, resulting not just in extreme debt but also in oversupply.

From a cultural perspective, a big emphasis is placed on multiple homeownership. More than 20% of urban households own multiple homes, which is more than many developed countries. A gender imbalance of 120 boys for every 100 girls means that men face intense competition to find a wife. This is made more problematic by Confucian principles, which see men as the “providers” of the family, making homeownership a prerequisite for marriage. This has led to a speculative real estate market, with many believing that housing prices will continue to rise. A bubble started forming, with land values growing higher and higher throughout the 2000s to 2020s.

In order to deflate the bubble, the government allowed Evergrande, a real estate developer with assets worth hundreds of billions, to collapse.

In the wake of the housing crisis, first came more property developers who faced financial stress and liquidation. Country Garden, China’s largest property developer, was the next to fall after Evergrande. The firm defaulted on dollar bonds for the first time in October last year. As a result, the company had been fighting for its life until it later faced a liquidation petition worth $205 million in February this year.

Beijing’s stance regarding the financial stress the property developers are currently facing has been mixed. Some articles state that the focus of the Chinese government at present is to ensure the completion of property projects and not to bail out the developers. Housing and urban-rural Development Minister Ni Hong stated at a press briefing that ‘houses were for living in and not for speculating on’. Reinforcing this, some also claim that the CCP plans to commit the equivalent of $280 billion to buying up private real estate developments repurposing them as rental units, and forbidding them to be traded on the open market. This is why when Evergrande liquidated, and now as Country Garden faces the heat, Beijing still chooses to do nothing. However, this has not been the case with the newest firm to bite the dust due to the crisis, Vanke Co. They reported a 46% decrease in year-on-year profits in March of this year, the lowest in its public history. Interestingly, despite the non-interventionism exhibited towards Country Garden and Evergrande, the government has taken a different stance for Vanke. Wherein they have urged Chinese banks to aid the troubled property giant in its liquidity issues. Per an article from the Sydney Morning Herald, it is in discussion with 12 of these banks, 6 of which are state-owned, about providing Vanke Co. 80 billion yuan of secured loans for liquidity to repay maturing bonds.

The housing crisis has also had a ripple effect on related markets within the Chinese economy. The most notable being the market for cement, a vital material in infrastructure development. The market for cement has predictably suffered from oversupply in the wake of crawling demand for properties.

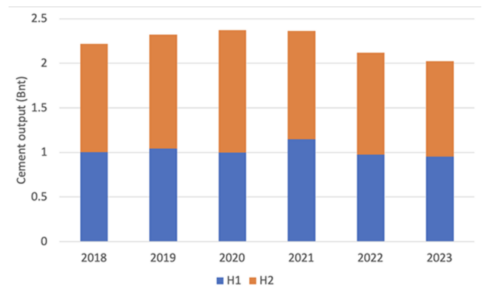

Figure 1. Source: National Bureau of Statistics of China.

The above graph displays the output of the cement industry in China. It can be observed from the above graph that there was a drop in output from 2023 (4.5% YOY). Though the cement industry has technically been in oversupply after exiting a prolonged period of growth in the 1990s and 2000s, it is reasonable to conclude that the decreased property investment stimulated by the sluggish real estate market played a hand in its decrease last year. In regards to the market for steel, another related commodity to the housing crisis, the effect on demand has been minimal. This is due to Chinese authorities encouraging the major steel mills to make up lost demand domestically by tapping into global export markets. However, such a play could apply greater pressure on foreign steel producers, furthering trade countries’ reliance on Chinese steel and possibly increasing the effect of the housing crisis internationally if circumstances worsen.

Following the crisis, many were reminded of the American subprime mortgage crisis that caused financial contagion beyond just the American real estate market. As China has become more economically and financially integrated with the world, any major downturn in its economy, especially if subject to mismanagement, can lead to contagion.

The government response towards the immensely destructive collapse of Evergrande and Country Garden was met with scepticism as the central government chose to adopt a more “hands-off” approach as opposed to bailing them out. China has been trying to cool down its property market, accepting short-term losses rather than suffer much larger long-term losses. That being said, there have been talks of bailing out Vanke, China’s second-largest real estate developer. Vanke has seen its credit rating be downgraded to junk, meaning that it is at a high risk of default.

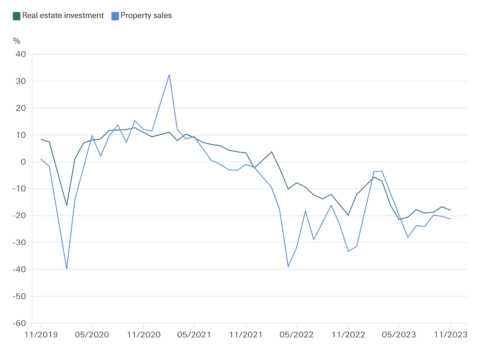

The effects of the property crisis have spilt over into the value chains of various industries within China. The property sector has felt the brunt of the crisis, with real estate investment and property sales crashing (Figure 2). Further restrictions, such as limits on home purchases, have been placed. Stemming from the government’s efforts to cool down the economy, however, China’s bond market is not seeing any evidence of property contagion as of now.

Figure 2. Source: Statistic Bureau of China, PBoC, Wind.

Overall, China’s over-reliance on the real estate industry as a major engine of economic growth, along with the country’s high debt levels, resulted in the massive, spiralling real estate crisis – sparking questions about the long-term viability of its economic growth. The crisis currently appears to be seeping into the employment, consumer spending and finances of local governments, which are heavily dependent on land sales to developers.

Beijing’s response is a mix of intervention and restraint, but economists are urging for more aggressive action to maintain China’s once-imposing economic growth rates. As China attempts to confront this crucial challenge, the stakes extend far beyond its borders – with its impacts resonating throughout the global economy. Therefore, a potential resolution will not only determine the stability of the Chinese economy but also of international markets, highlighting the imperative for astute policymaking in an increasingly interdependent world.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.