In July 2021, following the release of Q2 2021 financial statements to investors, Netflix announced via a shareholder letter and earnings call their intention to foray into the mobile gaming industry. This comes as a report from PricewaterhouseCoopers (PwC) reveals that revenue from the Australian mobile gaming industry is expected to grow yearly by an average of 7.5% from 2020 to 2025, supercharged by Australians looking for entertainment during isolating COVID-19 lockdowns. (8)

Gregory K. Peters, Chief Operating Officer and Chief Product Officer at Netflix, revealed plans in the earnings call to create stand-alone games and engage in video game licensing for their show franchises. The July shareholder letter goes on further, describing the investment into gaming as an extension of Netflix’s earlier efforts to establish games, such as the Black Mirror Bandersnatch ‘choose your own adventure’ film and the Stranger Things video games. (1,2)

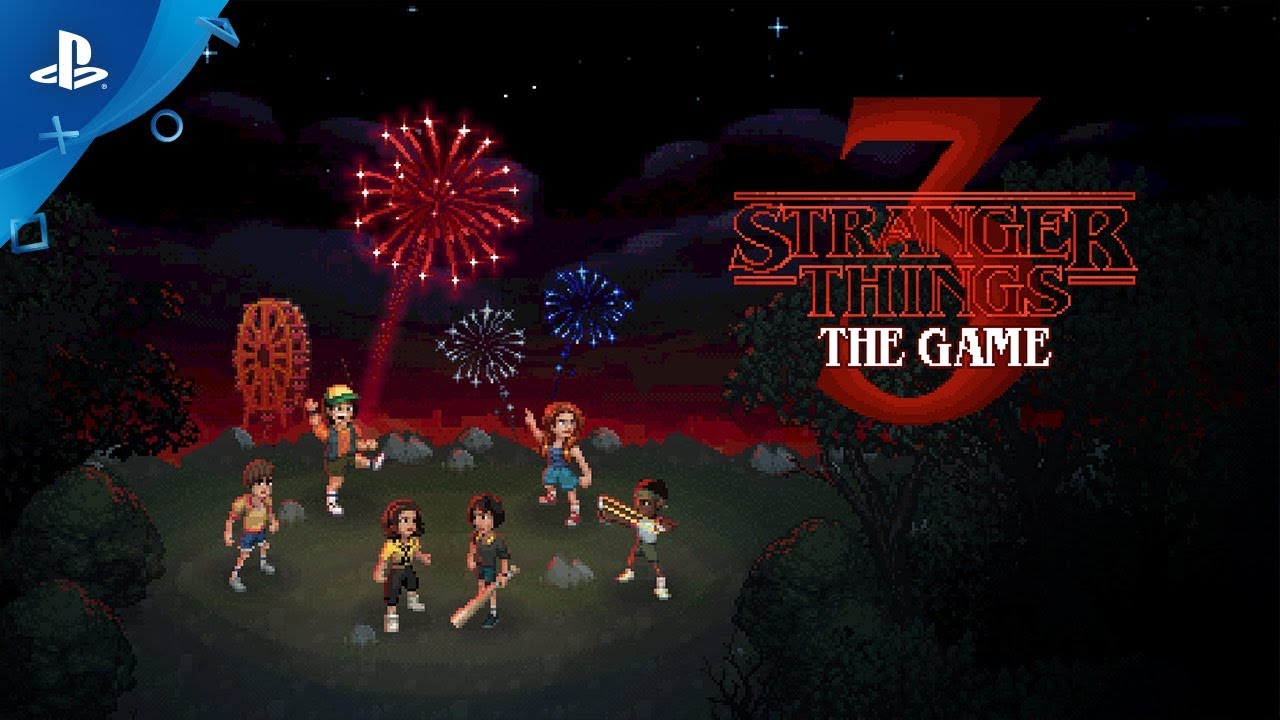

Netflix worked with game studio, BonusXP, to create two Stranger Things mobile games, titled Stranger Things and Stranger Things 3: The Game, with the latter receiving a port to PCs, the Nintendo Switch, Playstation 4 and Xbox One. Both games featured a retro pixel art style, mimicking the art style of games from 1980s, in which the Stranger Things show is set in. The games explored story elements that the show did not have time to explore. (10)

Peters believes this is a key differentiator that Netflix can offer by entering the gaming industry, by creating games that extend their existing Netflix franchises through world building and engaging storylines. (1,2,3)

He told investors that Netflix games would feature no ads, no in game purchases or other types of monetization, as there is not a focus on per title purchases. This is in departure from business models adapted by Activision Blizzard, where revenue is generated from player’s in-app purchases and microtransactions. These microtransactions can appear in the form of items in-game, such as cosmetic items or items which grant benefits in-game, as mentioned the CAINZ article: Harmless fun or virtual casinos? The rise of loot boxes and gacha in video games. (11)

Peters added that the gaming services offered by Netflix will extend upon their video streaming subscription services, essentially adding a gaming subscription service within their video subscription service. He mentions that the games will come at no additional cost to subscribers and will help its core revenue stream, subscription services. (1,2)

Game subscription services are a type of subscription service where a fee is paid for digital access to a library of games for a period of time, typically a month. The business model of game subscription services falls under the ‘games as a service’ (GaaS) category, where additional revenue can be generated from games after they have initially launched and allows gaming studios to continually work their games by introducing updates and new content. (9)

Electronic Arts’ EA Play and Microsoft’s Xbox Game Pass are just some of gaming subscription services available to gamers on the PC and console. Here, gamers can access a collection of the games such as Mass Effect Legendary Edition, which features various updates and improvements to the original Mass Effect games, and the Halo Master-chief Collection for a monthly fee.

Up until recently, app stores did not offer game subscription services to mobile gamers, meaning each mobile game had to be purchased outright from respective app stores. This changed in 2019, as both Google and Apple launched their app subscription services, Google Play Pass and Apple Arcade, with both services charging $7.99 AUD per month for subscription. (5)

While on the surface, both app subscription services seem to provide the same service but on a different mobile operating system, they differ in terms of the library of games and apps offered to their subscribers.

Google Play Pass gives subscribers access to over 800 games and apps, which includes popular and classic games such as Risk and Star Wars: Knights of the Old Republic (KOTOR). This is in contrast to the Apple Arcade, which trades off game library size for the opportunity for users to try new and exclusive games on the IOS platform. Games such as The Last Campfire, an adventure puzzle game developed and published by the infamous and renowned creators of No Man Sky, are exclusive games to the IOS platform. (5)

With reports and rumors that games will be added to the Netflix app in 2022, Netflix’s mobile gaming subscription service would therefore likely have to contend with Google Play Pass and the Apple Arcade for market share. However, unlike Google and Apple, Netflix might be able to leverage cross-platform aspect of their app, allowing Netflix’s games to reach both Android and IOS users. (3)

However, not everyone is convinced by Netflix’s investment into gaming. Michael Pachter, an analyst at Wedbush Securities, believes that Netflix is simply using games as a ‘shiny new object that might distract investors from what we perceive to be [its] slowing growth’. (4)

Pachter finds similarities with Disney’s unsuccessful attempts to start up a gaming division and Netflix’s proposed creation of games that expand off existing IPs and franchises. He states that ‘very few movies make it as games … I don’t see any [Netflix] properties except Stranger Things that would make a good game.’ Disney closed its game development business in 2016, opting to engage in game licensing for their franchises and acquisitions, such as Star Wars and Marvel. This allowed experienced gaming studios such as Electronic Arts (EA) to develop games for Disney IP such as Star Wars Jedi: Fallen Order, which received overwhelming praise from the gaming community. (4,7)

Despite news about investment into mobile gaming, markets overall responded negatively to Netflix’s earnings. Financial reports released in Q2 2021 showed that from Q4 2020 and Q1 2021, there was slump in revenue growth from 24.2% to 19.4% and that subscription growth fell from 13.6% to 8.4% in the same period. The market’s negative reaction was reflected in a drop in Netflix’s share price, which fell saw it fall by 3.3%. (2,6)

1. Netflix, Inc. NasdaqGS:NFLX FQ2 2021 Pre Recorded Earnings Call Transcripts. (2021). Retrieved 25 July 2021, from https://s22.q4cdn.com/959853165/files/doc_financials/2021/q2/Netflix,-Inc.,-Q2-2021-Pre-Recorded-Earnings-Call,-Jul-20,-2021.pdf

2. FINAL-Q2-21-Shareholder-Letter.pdf. (2021). Retrieved 25 July 2021, from https://s22.q4cdn.com/959853165/files/doc_financials/2021/q2/FINAL-Q2-21-Shareholder-Letter.pdf

3. Netflix will soon stream games to your phone. When it’s coming, what games, more. (2021). Retrieved 25 July 2021, from https://www.cnet.com/tech/services-and-software/netflix-will-soon-stream-games-to-your-phone-when-its-coming-what-games-more/

4. Why Netflix is moving into gaming. (2021). Retrieved 25 July 2021, from https://www.ft.com/content/7d84dfa0-c88a-4380-85a0-9e9db46124f5

5. Apple Arcade vs. Google Play Pass: Which $5 game streaming service wins?. (2020). Retrieved 25 July 2021, from https://www.cnet.com/tech/services-and-software/apple-arcade-vs-google-play-pass-which-5-game-streaming-service-wins/

6. Netflix, Inc. Common Stock (NFLX). (2021). Retrieved 25 July 2021, from https://www.nasdaq.com/market-activity/stocks/nflx

7. How Disney took over video games after closing all of its studios. Retrieved 25 July 2021, from https://www.polygon.com/e3/2021/6/16/22533193/disney-took-over-video-games-avatar-star-wars-indiana-jones-e3-2021

8. Interactive games. (2021). Retrieved 26 July 2021, from https://www.pwc.com.au/industry/entertainment-and-media-trends-analysis/outlook/interactive-games.html#chart-data

9. Top Video Game Companies Won’t Stop Talking About ‘Games As a Service’. (2017). Retrieved 26 July 2021, from https://kotaku.com/top-video-game-companies-wont-stop-talking-about-games-1795663927

10. How ‘Stranger Things 3: The Game’ Will Take Player Beyond the TV Show. (2019). Retrieved 26 July 2021, from https://variety.com/2019/tv/news/stranger-things-3-the-game-plot-details-1203175106/

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.