As many cryptocurrencies gain media attention and edge closer to mainstream adoption, XRP has emerged as a key player in the digital economy. It is the native token of the XRP ledger (XRPL), an open-source and decentralised blockchain built for fast and low-cost transactions. While often synonymous with Ripple, XRP is independent of the company. Instead, Ripple uses XRP for its digital payment solutions aimed at replacing financial systems like SWIFT. XRP’s growing institutional interest, speed and utility have ignited a debate about its position in global finance. Could XRP reshape global transactions, or will it be another coin that comes and goes?

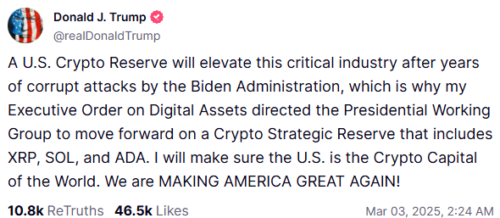

Following Trump’s inauguration, the spotlight on crypto has emphasised the necessity of embracing digital assets. The favourable political climate has shifted in favour of crypto with Trump’s executive order to form a cryptocurrency reserve. A Truth Social media post delineating the inclusion of XRP in this strategic reserve reinforces America’s stance on crypto. This positions XRP as part of the U.S.’s plan to become the ‘Crypto Capital of the World.’

Figure 1: Truth Social post about XRP

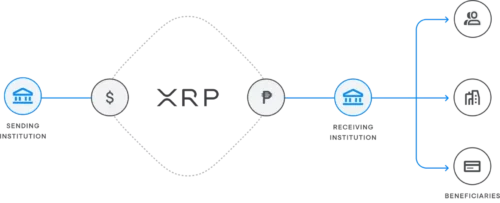

SWIFT, the backbone of international money transfers, is often criticised for its high fees and slow processing times. The remedy to these inefficiencies is XRP, which creates the potential for Ripple’s XRP solutions to supplant traditional payment systems such as SWIFT. XRP functions as an intermediary currency that facilitates conversion between different fiat currencies. Ripple’s XRP-based payment solution, On-Demand Liquidity (ODL), allows vendors to obtain their preferred currency without requiring buyers to possess it.

Figure 2: Payment Using On-Demand Liquidity

XRP’s functionality has led many institutions to partner with Ripple to join their RippleNet, a blockchain alternative to SWIFT. Notable partnerships include American Express, Airwallex, and SBI Remit, reflecting heightened interest in cross-border payment infrastructure. According to NASDAQ, 80% of Japan’s banks will integrate XRP into their systems by 2025, which indicates a growing interest in XRP by countries.

Ripple’s expansion efforts are amplified through its recent acquisition of prime brokerage firm Hidden Road. Handling over $3 trillion in global transactions annually and access to 300 institutional clients, this acquisition boosts Ripple’s institutional reach. By integrating crypto infrastructure with established capital flows, Ripple is building the foundation for a new phase in institutional finance. If successful, the Hidden Road acquisition could solidify XRPL as a backbone for a blockchain compatible financial system, leading to a highly bullish view of XRP.

While not primarily seen as an investment vehicle, the Teurcrium 2x Long Daily XRP ETF (XXRP) signifies burgeoning retail interest in XRP as an investment asset. It is the first XRP-based ETF and offers exposure to twice the daily performance of XRP, catering to those seeking amplified exposure to XRP.

The Securities and Exchange Commission’s (SEC) legal battle against Ripple had impeded XRP’s potential adoption rate and price. The SEC alleged that the sale of XRP could be considered an investment contract and, therefore, a security under the law. In 2023, Judge Analisa Torres partially sided with both parties, ruling that the sale of XRP on public exchanges to retail investors didn’t constitute a security under federal laws.

However, the sale of XRP to institutional investors did, resulting in a fine of USD 125 million to Ripple. This ruling marks a turning point in cryptocurrency history and follows suit with many lawsuits against other crypto companies, such as Coinbase and Kraken, being dropped. This decision provides regulatory clarity for the digital asset industry. It will likely attract institutions that stay clear of the SEC to explore Ripple’s XRP-based payment solution and champion innovation.

Figure 3: Ripple CEO Brad Garlinghouse, Chief Legal Officer Stuart Alderoty and Donald Trump

Europe, Singapore, and Japan have embraced stances to similar to the US by setting clear guidelines for crypto innovation. Comparatively, China has imposed strict bans on crypto trading and mining activities. A disconnected patchwork approach to regulation makes global cryptocurrency adoption challenging because compliance requirements across borders can hinder innovation and limit the scalability of use.

Another risk to XRP is Stablecoins and Central Bank Digital Currencies (CBDCs). Stablecoins are cryptocurrencies whose value is pegged to another asset to maintain a stable price. They strive to provide an alternative to the high volatility of popular cryptocurrencies, making them potentially more suitable for transactions. CBDCs are digital versions of a country’s official currency controlled by the central bank. The rise of Stablecoins and CBDCs has the potential to divert attention and resources away from XRP, threatening mainstream adaptability due to an overlap in purpose.

The increasing involvement of institutions and central banks in blockchain technology is also about control. Blockchain is a way organisations can streamline operations, reduce fraud, and maintain oversight over transactions. However, while blockchain was designed to decentralise power, big institutions integrating it could end up reinforcing centralisation under a new guise. Ultimately, this raises the concern whether cryptocurrency is truly decentralised or centralised.

Ranking fourth in market capitalisation behind Bitcoin, Ethereum, and Tether, the proliferating interest in XRP has caused a shift in how transactions can occur. Although Bitcoin holds the largest market cap and is regarded as a store of value by most, its practical use for institutional purposes is limited. Firstly, the cost per token is drastically higher than that of XRP. For this reason, Bitcoin is mainly a store of value and is better for investment purposes. Bitcoin has a supply of 21 million tokens and must be actively mined. The downside to mining is that it requires electricity, precipitating high network fees and slow transactions.

XRP’s less volatile nature enhances its reliability for transactions. The total supply of XRP is capped at 100 billion tokens, which are pre-mined. Ripple placed 55 billion of these tokens into escrow accounts, gradually releasing them to maintain liquidity and prevent hyperinflation. Although in escrows, Ripple’s possession of a considerable portion of the supply of XRP arouses scepticism regarding XRP’s independence from Ripple. Additionally, it’s worth noting that Ripple’s past influence over validators have also escalated questions about XRP’s decentralisation.

After hovering just below $1 for most of 2024, Trump’s presidential triumph against Kamala was XRP’s breakout moment in the crypto bull market. XRP gained enormous momentum in November, rising above $3, breaking resistance levels and reaching multi-year highs.

Early in January, the CEO, Brad Garlinghouse and Ripple’s chief legal officer, Stuart Alderoty, had a private dinner with Donald Trump and donated $5 million in XRP to Donald Trump’s inaugural committee. Around this time, XRP achieved a new all-time high price of $5.35 days before Trump began his term. The coin was the biggest beneficiary postelection and is up more than 330%, stabilising at around $3.37. The announcement of the U.S. cryptocurrency reserve and Ripple’s success against the SEC caused a surge in XRP’s price.

The recent turbulence in the cryptocurrency market mirrors the stock market, which tariffs and uncertainty have driven. XRP’s price history reflects its ability to adapt and recover. Its ability to hold key support zones during bearish periods and surge past resistance levels during bullish runs suggests it thrives in favourable market conditions. Although future prices are uncertain, with the newfound support from the Trump administration, some predictions suggest that XRP could reach USD 5.50 in 2025.

Figure 6: XRP Price Predictions

As its role in the digital asset landscape evolves, XRP is in a more advantageous position due to Ripple’s close ties with the Trump administration. The nuances of digital assets have heightened confidence in the market and increased the likelihood of widespread adoption. Although not intended as an investment, XRP may be feasible if the price rallies, with institutional investors backing it and a large capital inflow. Time will tell whether institutions fully embrace XRP as the standard for global transactions.

Browne, R. (2017, November 16). American Express, Santander team up with Ripple for cross-border payments via blockchain. CNBC. https://www.cnbc.com/2017/11/16/american-express-santander-team-up-with-ripple-on-blockchain-platform.html

Coinbase. (2025). What is a stablecoin? @Coinbase; Coinbase. https://www.coinbase.com/en-au/learn/crypto-basics/what-is-a-stablecoin

Coinspot. (2020). Ripple Vs. Bitcoin: What is XRP? Coinspot.com.au. https://www.coinspot.com.au/learn/ripple-vs-bitcoin

Garlinghouse, B. (2025). Great dinner last night with @realDonaldTrump & @s_alderoty . Strong start to 2025! X (Formerly Twitter). https://x.com/s_alderoty/status/1876794729137856911

George, K. (2024, September 20). Cryptocurrency Regulations Around the World. Investopedia. https://www.investopedia.com/cryptocurrency-regulations-around-the-world-5202122

Kharif, O., & Shen, M. (2024, December 20). Kraken, Ripple, Ondo Finance Donate to Trump Inaugural Committee (XRP). Bloomberg.com; Bloomberg. https://www.bloomberg.com/news/articles/2024-12-20/kraken-ripple-ondo-finance-donate-to-trump-vance-inaugural-committee-xrp?embedded-checkout=true

Khatri, Y. (2025, April 8). Standard Chartered sees XRP jumping over 500% to $12.50 by 2028, expects XRP ETF approval in Q3 2025. The Block. https://www.theblock.co/post/349999/standard-chartered-xrp-price-target-xrp-etf-approval

Kirui, J. (2025, April 8). Will XRP be the Next Bitcoin? Price Stable as Ripple Acquires Prime Broker Hidden Road. Financial and Business News | Finance Magnates. https://www.financemagnates.com/trending/will-xrp-be-the-next-bitcoin-price-stable-as-ripple-acquires-prime-broker-hidden-road/

Ledger Insights. (2020, April 17). Ripple partner Airwallex raises $160m for payment solution – Ledger Insights – blockchain for enterprise. Ledger Insights – Blockchain for Enterprise. https://www.ledgerinsights.com/ripple-partner-airwallex-raises-160m-for-payment-solution/

Masrani , A. (2025). 80% of Japanese Banks Set to Embrace XRP for Global Payments by 2025. Nasdaq.com. https://www.nasdaq.com/articles/80-japanese-banks-set-embrace-xrp-global-payments-2025

Rafael, T. (2025, April 8). Ripple Agrees to Acquire Prime Broker Hidden Road for $1.25B in One of the Largest Deals in the Digital Assets Space – HiddenRoad. HiddenRoad. https://hiddenroad.com/ripple-agrees-to-acquire-prime-broker-hidden-road-for-1-25b-in-one-of-the-largest-deals-in-the-digital-assets-space/

Reiff, N. (2021, July 27). What’s the Difference Between Bitcoin and Ripple? Investopedia. https://www.investopedia.com/tech/whats-difference-between-bitcoin-and-ripple/

Reserve Bank of Australia. (2024, September). Central Bank Digital Currency. Reserve Bank of Australia. https://www.rba.gov.au/payments-and-infrastructure/central-bank-digital-currency/

Sarin, S. D. (2023, December 16). Extended Interview – On-Demand Liquidity. Flipthechain.com. https://flipthechain.com/ripple-odl-will-it-increase-xrp-price/

SBI Remit Co., Ltd. (2023, September 5). XRP-based International Money Transfer Service Using Ripple’s Payments Solution to be Gradually Expanded in the Philippines, Vietnam, and Indonesia | SBI Remit Co., Ltd. SBI Remit Co., Ltd. | 国際送金・海外送金はお得な手数料のSBIレミットなら、最短10分程度でマネーグラム取扱店(世界約200カ国と地域に約25万拠点)へ海外送金が可能です。在日外国人の方に便利な多言語のサポートも万全です。. https://www.remit.co.jp/en/kaigaisoukin/information/release20230906/

SEC. (2025). SEC.gov | SEC Announces Dismissal of Civil Enforcement Action Against Coinbase. Sec.gov. https://www.sec.gov/newsroom/press-releases/2025-47

Stempel, J. (2025, March 3). Kraken says US SEC to dismiss lawsuit against the cryptocurrency exchange. Reuters. https://www.reuters.com/legal/kraken-says-sec-dismiss-lawsuit-2025-03-03/

Stempel, J., & Niket Nishant. (2025, March 19). Ripple Labs says US SEC ends appeal over crypto oversight. Reuters. https://www.reuters.com/legal/ripple-ceo-says-us-sec-will-drop-appeal-against-crypto-firm-2025-03-19/

Teucrium. (2023). XXRP | Teucrium. Teucrium.com. https://teucrium.com/etfs/XXRP

Théaud, B. (2024, February 8). How Long Do SWIFT Payments Take? Insights From 1,000 Payments [2nd Edition]. Statrys. https://statrys.com/blog/how-long-does-a-swift-transfer-take

Trump, D. (2025). Truth Social. Truth Social. https://truthsocial.com/@realDonaldTrump/posts/114093526901586124

XRPL. (2024a). XRP Overview. Xrpl.org. https://xrpl.org/about/xrp

XRPL. (2024b, September 23). An Explanation of Ripple’s XRP Escrow. Xrpl.org. https://xrpl.org/blog/2017/explanation-of-ripples-xrp-escrow

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.