Introduction

Amid looming threats of economic downturn, investors have flocked towards a precious metal that has fueled the rise of empires and whose value will likely outlast your Bitcoin wallet—gold. With an impressive track record in times of market volatility, gold has been widely regarded as a safe-haven asset—but is it still the ultimate hedge in today’s age?

A Brief History of Gold

Since the time of the ancient Egyptians, gold has held various functions—from currency to crown jewels and was even believed to bridge the mortal to the divine. Civilizations have prized gold not just for its beauty but also its unique properties; gold does not corrode, tarnish, or succumb to inflationary pressures, as some investors today attest. As such, several central banks worldwide have stockpiled it as financial insurance. Its most remarkable feature, however, lies in its ability to retain its value, especially in times of financial crisis.

Australia has one of the world’s largest underground gold reserves. In the 1850s to 1870s, the Australian gold rush invited masses of opportunists to the country in hopes of striking a fortune. While the gold rush era has ended, Australia still maintains its status as the third largest exporter for the resource. On the other side of the world, gold served as a commodity that shaped the fabric of a country’s economy. Following the end of the Second World War, the United States implemented the gold standard—a monetary system wherein the currency was directly linked and convertible to gold. By limiting the value of the currency to the scarcity of the resource, there would be less burden on the shoulders of authorities to regulate and monitor price levels, which helped reduce inflation. In 1971, however, US President Richard Nixon announced the permanent annulment of the gold standard, asserting that this was a necessary defense against an “all-out war against the American Dollar” as gold supply decreased. Additionally, its function to limit the control of policymakers was a double-edged sword that temporarily curbed inflation but also straitjacketed economic policy. During times of downturn, the US could not introduce changes to interest rates and money supply due to the risk of depleting gold reserves.

Today, the value and role of gold is more nuanced than ever. While it remains a refuge when trust in governments and markets wavers, its status as a safe-haven asset hides some contradictions: it brings stability in spite of crises but is still prone to short-term volatility and, while it can hedge against inflation, it does not offer yields as high as bonds or stock. Hence, the question arises: is gold really a necessary investment in a period of financial turmoil or is it a gilded relic that will cost you more than it shines?

Figure 1. Historical price of gold.

Source: The Royal Mint

The Case For Gold: Timeless Value in a Volatile Market

Throughout much of modern history, investment in gold has consistently been viewed and vindicated as a secure, robust, and sensible choice. Given that the global economic turmoil of the post-COVID era shows little signs of abating, the case for gold as an asset class has been significantly strengthened for retail and institutional investors alike.

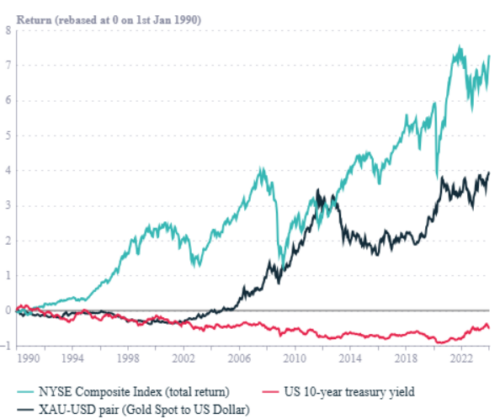

Perhaps the most appealing quality of gold to the prospective investor is its unrivalled track record when it comes to crisis resilience. Given gold’s historical low correlation with other assets (particularly stocks and bonds), and as confidence dwindles in equity markets, capital often begins to flow into gold markets. Two illustrative recent examples of this phenomena are the dDot-cCom Bubble (1995-2001) as well as the Global Financial Crisis (2007-2008) – two periods in which traditional assets plummeted. In both cases, from market trough to recovery, the value of gold increased 167.29% and 69.36% respectively as investors fled the volatile stock markets.

Another equally attractive characteristic of gold is its ability to serve as a strong hedge against inflation in the long run. This is in part due to two major contributing factors; an enduring intrinsic value as well as a limited supply. As opposed to fiat currencies, gold is a tangible asset, which has been perceived as symbolic of wealth, power and royalty for thousands of years. In addition, gold is a scarce resource, being both rare and difficult to extract, meaning that in times of high demand, the value of gold invariably appreciates. The combination of these two primary factors has led to gold maintaining its purchasing power over time. By way of example, from 2019-2024 alone, the U.S dollar has lost a staggering 25% of its purchasing power due to inflation. Over the same time frame, the value of gold appreciated by 87% underscoring its role as the far superior method of wealth preservation.

Figure 2. Performance of gold vs. debt and equity.

Source: Refinitiv

“The Case Against Gold: Costs, Volatility, and Practicality”

The rising price of gold has made the metal more valuable than ever, peaking at a price higher than $3000 USD. However, the factors influencing its price surge consist of rising inflation and a weakening dollar, signalling economic uncertainty.

Gold’s price may have reached its zenith, leading to the uncertainty of whether the price will fall or continue to rise in an increasingly volatile market. The fluctuating price of gold signals that it is difficult to assess the metal’s profitability since American President Donald Trump’s decisions have caused significant economic uncertainty in the market. So, gold may prove to be a worthwhile asset for individuals already owning gold prior to its rise in value. As a consequence of Trump’s implementation of tariffs, there are higher taxes on gold, presaging a surge in the United States of America’s gold price. The current largest miner of gold in the world is China, a country which currently faces 125% tariffs from the USA. While gold is a strong hedge against currency devaluation and inflation, it still faces risks from geopolitical events that may impact its price.

Investing in gold incorporates either purchasing physical gold or gold exchange traded funds (ETFs). When purchasing physical gold, the most direct way to invest is to buy bullion (gold in bulk) in the form of gold bars or coins. However, several people also purchase gold in the form of jewellery. Purchasing physical gold incurs storage costs in the form of lockers, safety vaults, and safe home storages. Several cases of gold robbery are reported on a daily basis. Recently, on the 19th of March 2025, two men were found guilty of conducting a multi-million dollar gold toilet heist from the Blenheim Palace. EFT fund managers require a recurring annual fee (an expense ratio of up to 0.4%) charged by funds to cover management and administration costs. Gold does not generate income other than through increases in its price, so it does not necessarily recoup storage costs.

Conclusion

In essence, gold is most certainly a prized possession in today’s economy, but only time will tell whether it is as a worthwhile hedge in any portfolio or if geopolitical risks and the economic costs of owning gold cause investors to shy away from a material as old as civilization.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.