2017 was an irreversible year for crypto. Marked by arguably one of Bitcoin’s most significant bull-runs, followed by ICO (Initial Coin Offering) booms and mass media attention, it has shifted public perception of crypto, for good. Although investor sentiments has evolved dynamically from excitement (2017), skepticism (2018) and institutional interest (2020-2021), everyone has been paying more attention to crypto; whether in hope of getting another shot, or not wanting to miss out on quick and easy money. Since crypto is becoming an increasingly hot topic, with events like Trump’s re-election, greater institutional adoption and shift towards CBDC (Central Bank Digital Currencies) shaping its future, I felt compelled to explore its implications myself.

Unlike traditional stocks, which have intrinsic ties to a company’s earnings, assets, and market performance, cryptocurrencies derive their value from factors like scarcity, demand, and technological innovation. This unique valuation model has contributed to the rapid growth and adoption of crypto assets, but also presents challenges in terms of regulation and market stability. This divergence from traditional financial valuation is not just novel, it’s disruptive. But with disruption comes confusion, and often, exploitation. A question that comes into my mind is, should perceived scarcity alone justify billion-dollar valuations? Or are we fuelling a modern day gold rush under the guise of innovation?

With scarcity and speculation, are we investing in the future, or chasing digital gold? Source: Shutterstock

Layer 1 blockchains are the foundation of the crypto world—they are the base networks that support transactions, smart contracts, and decentralised applications. Bitcoin was the first and remains the most well-known, but newer blockchains like Ethereum and Solana are driving innovation by improving speed, scalability, and functionality. They continue to experience significant development activities, focusing on scalability, consensus mechanism evolution and decentralisation. Bitcoin remains the foundation of the crypto ecosystem, standing as one of the first successful decentralised digital benchmarks of crypto. Its influence on market cap and recent institutional adoption, guarantees its relevance. However, its role as a settlement layer than an innovation hub is becoming clearer, in contrast to other coexisting blockchains in this ecosystem. This is why attention is gradually shifting to other Layer 1s, notably Ethereum and Solana, which offer more flexibility for innovative developers.

Ethereum, one of the largest Layer 1 blockchains, has made substantial advancements in recent years. Its 2024 Dencun upgrade and EIP-4844 aim to improve scalability and reduce transaction fees by enabling more efficient data handling. This follows its 2022 transition to Proof of Stake (PoS), which significantly enhanced the network’s energy efficiency.

At the core of Ethereum’s ecosystem are smart contracts, which are self-executing programs that automatically run when predefined conditions are met. These contracts enable decentralised applications (dApps) across finance, gaming, and digital ownership, making Ethereum the go-to platform for developers building in Web3. This dominance is further reflected in Ethereum’s Total Value Locked (TVL), which continues to exceed its competitors as a central platform for decentralised finance.

Ethereum Token Price vs TVL. Source: DeFiLlama

However, competition in this ecosystem is fierce. Solana, boasting its high speed and low cost infrastructure has attracted developers looking for an agile crypto environment. This trend was underscored by the departure of Max Resnick, a longtime Ethereum developer at Consensys, who recently moved to the Solana ecosystem. Resnick cited Ethereum’s slow governance process and lack of agility as barriers to innovation, contrasting it with Solana’s more flexible development environment.

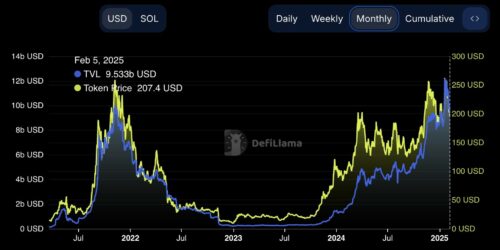

Solana, with its decentralised finance total value locked (TVL) reaching $9 billion for the first time in three years, has continued to refine its Proof of History (PoH) and Proof of Stake (PoS) consensus mechanism to enhance performance. Solana’s growth is signalled by its surging TVL, showing renewed trust and activity in the ecosystem.

Solana Token Price vs TVL. Source: DeFiLlama

Bitcoin Exchange Traded Funds (ETFs) have also garnered substantial attention especially after gaining regulatory approval from US SEC (Securities and Exchange Commission). With major financial institutions launching products such as the ProShares Bitcoin Strategy ETF (BITO), BITO offers investors exposure to Bitcoin’s price movements without the need to directly own the cryptocurrency. This development has elevated Bitcoin’s profile in traditional financial markets, allowing broader investor participation.

In addition to BITO, other financial institutions have introduced Bitcoin-linked ETFs, further integrating Bitcoin into mainstream finance. For instance, Franklin Templeton has applied for regulatory approval to launch a new crypto index ETF, potentially including Bitcoin and Ether, reflecting growing institutional interest in digital assets.

However, this raises an important question. Why seek exposure through ETFs instead of investing in Bitcoin directly? Buying an ETF only means you own some shares of the fund, instead of actually owning the cryptocurrency yourself. Additionally, most accessible spot-based ETFs are currently limited to Bitcoin and Ethereum, which elucidates regulators’ continued caution towards the implication of a broader crypto market. In the long run, I expect crypto ETFs to function similarly to gold ETFs, providing investors with market exposure without requiring them to physically hold the asset. Whether this will bring long-term stability to the crypto market or fuel speculation disconnected from real ownership remains to be seen.

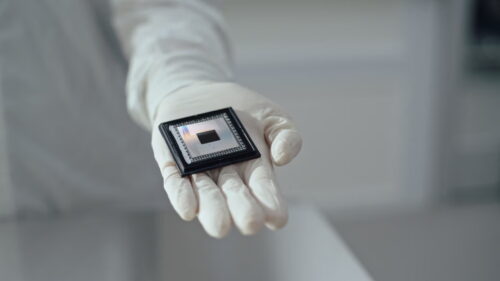

The unveiling of Google’s quantum computing chip, Willow, has reignited fears towards cryptocurrency security. Since Bitcoin and other blockchains rely on cryptographic encryption for security, quantum computing, in theory, has the potential to break current encryption methods and “end” crypto. In reality? Crypto isn’t waiting idle to be broken.

While Google’s Willow, which operates with 105 qubits, is a significant milestone in quantum computing, it still lacks the scale and error-correction capabilities needed to break current cryptographic schemes. For now, quantum computers lack the power and stability to break blockchain encryption, requiring millions of qubits with near-zero error rates, something still far from reality. Meanwhile, the industry is already preparing, with quantum-resistant algorithms under development to ensure the continued security of decentralised networks.

Hypothetically, even if quantum computing becomes powerful enough to break blockchain, is it going to completely kill crypto? I predict not. It seems more likely that the crypto industry will shift away, perhaps from decentralised notions into more government approved, secure and institutional friendly versions for blockchain networks. Whether my predictions are correct or completely wrong, is besides the point. Just as the internet didn’t die off under the threat of viruses, the cryptographic industry will adapt and develop, like any other technology.

‘Willow’, Google’s new quantum computing chip. Source: Reuters

Enterprise blockchain adoption has seen significant breakthroughs in 2024-2025, particularly in asset tokenisation, supply chain management, and Central Bank Digital Currencies (CBDCs). Tokenisation of real-world assets (RWA) is becoming more common as clearer rules allow big companies to bring real estate, stocks, and bonds onto blockchain networks. For example, in January 2025, Dubai’s DAMAC Group partnered with blockchain firm MANTRA to turn $1 billion worth of real estate into digital tokens, making it easier to trade and manage property online. In supply chains, companies like VeChain and Hyperledger are using blockchain to track products more accurately, helping the pharmaceutical and luxury goods industry fight against counterfeiting while reducing costs. On the CBDC front, China’s digital yuan is being tested for cross-border payments, and the European Central Bank is exploring a digital euro that could allow smart contract payments. These moves show how blockchain is becoming a bigger part of global finance.

The increasing involvement of major corporations and central banks in blockchain isn’t just about innovation—it’s about control. Institutions see blockchain as a way to streamline operations, reduce fraud, and, in the case of CBDCs, maintain oversight over digital transactions. While greater institutional adoption signals mainstream acceptance, it also raises concerns. Blockchain was designed to decentralise power, yet big institutions integrating blockchain could end up reinforcing centralisation under a new guise.

Similarly, CBDCs are often marketed as an evolution of money, but they also introduce concerns about privacy and government control. Unlike decentralised cryptocurrencies, digital fiat currencies could give central banks unprecedented surveillance over transactions. Is this really the ‘crypto revolution’ we envisioned?

CBDCs promise efficiency, but at what cost to privacy? Source: WHU

Layer 2 solutions are designed to fix some of blockchain’s biggest problems—high fees and slow transactions. Instead of processing everything on the main chain, they create faster, cheaper ways to interact with pre-existing blockchains like Ethereum.

As Ethereum adoption grows, Layer 2 solutions have become essential, allowing the network to scale without sacrificing security or decentralisation, while still taking advantage of the foundation blockchain’s security. The rapid growth of rollups like Arbitrum and Optimism signals that Ethereum’s long-term success may depend on Layer 2 innovation.

Arbitrum continues to lead the Layer 2 ecosystem, surpassing 1 billion transactions, with its growth driven by developer adoption and deep integrations with DeFi protocols like Aave and Curve. The introduction of the AnyTrust protocol has further improved scalability by reducing data availability costs for rollup transactions, enhancing Arbitrum’s efficiency for enterprise and DeFi applications. Optimism has expanded its presence with the OP Stack, a modular framework that allows developers to create custom Layer 2 solutions, facilitating broader collaboration through its Superchain initiative.

Such modular and inter-connective expansions definitely showcase Layer 2 ecosystem’s innovation, but I wonder if we’re transitioning towards a more fragmented ecosystem, since each chain could end up functioning independently in the near future. Layer 2 solutions are currently processing billions of transactions, but will they still be needed once Ethereum outgrows its problems that roll ups were trying to fix?

Regulation remains a major factor shaping the future of crypto, with governments worldwide working to balance innovation and investor protection. Personally, I believe in regulation to some extent. Without it, scams, rug pulls and market manipulation could severely damage the industry’s credibility in the eyes of the public. That said, with overregulation, the blockchain space could be restricted by innovation before getting a chance to fully mature.

The U.S. Securities and Exchange Commission (SEC) continues to push for stricter oversight, targeting exchanges and DeFi platforms to enforce securities laws. However, political changes could shift this approach. Current U.S. President Donald Trump’s campaign has hinted at a more crypto-friendly stance, contrasting with the Biden administration’s stricter policies. His re-election could bring a softer regulatory environment, encouraging institutional adoption and business-friendly policies.

Trump positions Bitcoin and crypto as part of America’s financial future. Source: LAtimes

Beyond the U.S., regulatory frameworks are evolving globally. The European Union’s Markets in Crypto-Assets (MiCA) regulation is setting a precedent for clearer guidelines, while the UK and South Korea are also refining their crypto policies. Australia’s approach has also been noteworthy, as we continue to focus on creating a balanced regulatory framework for digital assets. The Australian government has committed to regulating digital assets with a view to fostering innovation while ensuring consumer protection.

As these frameworks develop, 2025 could see greater regulatory harmonisation, reducing uncertainty for businesses and investors while maintaining consumer protections. However, it’s pretty concerning that the future of crypto may rely on political cycles, with one administration welcoming innovation and the other clamping it down harder than ever.

Crypto has definitely come a long way since its speculative boom in 2017. Having started off as a fringe movement and unknown to most people, its evolving ecosystem now demands the attention of governments, banks and institutions around the world. In 2025, we are watching crypto’s original goal of decentralisation clash with the realities of regulation, scalability and adoption.

To me, the most interesting part is how this technology would change, rather than whether it would survive. Crypto isn’t going anywhere, whether it gets absorbed into traditional finance, or remains as a technological resistance against corporate and institutional power, the future of crypto will challenge our interaction with value, trust and systems of control.

Arbitrum. (2025, March). How Arbitrum Works: AnyTrust Protocol. Arbitrum Documentation. https://docs.arbitrum.io/how-arbitrum-works/anytrust-protocol

Asia Nikkei. (2024, November). China explores cross-border uses for digital yuan in new trial. https://asia.nikkei.com/Business/Markets/Currencies/China-explores-cross-border-uses-for-digital-yuan-in-new-trial

Block, The. (2025, January 2). Arbitrum One surpasses 1 billion transactions since 2021 launch. https://www.theblock.co/post/318821/arbitrum-one-surpasses-1-billion-transactions-since-2021-launch

Blockchain Council. (2024, December 10). Can Google’s Willow Crack Bitcoin? https://www.blockchain-council.org/cryptocurrency/can-googles-willow-crack-bitcoin/

Britannica. (2024, March 23). Cryptocurrency ETF Investing. https://www.britannica.com/money/cryptocurrency-etf-investing

CoinDesk. (2024, November 6). Is Optimism’s Superchain Winning the Ethereum Layer 2 Race? https://www.coindesk.com/tech/2024/11/06/is-optimisms-superchain-winning-the-ethereum-layer-2-race

CoinDesk. (2024, December 9). Ethereum Dev Max Resnick Defects to Solana, Citing Frustration. https://www.coindesk.com/tech/2024/12/09/ethereum-dev-max-resnick-defects-to-solana-citing-frustration

CoinDesk. (2025, January 1). A Year of Crypto Tech in Review. https://www.coindesk.com/tech/2025/01/01/a-year-of-crypto-tech-in-review

Cointelegraph. (2023, September). Crypto Regulations in South Korea. https://cointelegraph.com/learn/articles/crypto-regulations-in-south-korea

Cornerstone Research. (2025, January). SEC Cryptocurrency Enforcement: 2024 Update. https://www.cornerstone.com/wp-content/uploads/2025/01/SEC-Cryptocurrency-Enforcement-2024-Update.pdf

Crypto News. (2024). Blockchain Development Trends. https://crypto.news/blockchain-development-trends/

Forbes. (2017, October 25). Bitcoin’s IPO Moment Has Arrived. https://www.forbes.com/sites/outofasia/2017/10/25/bitcoins-ipo-moment-has-arrived/

Forbes. (2024, December 13). Is Europe’s Digital Euro the Future of CBDC or Futile Effort? https://www.forbes.com/sites/jonegilsson/2024/12/13/is-europes-digital-euro-the-future-of-cbdc-or-futile-effort/

GT Law. (2025). Blockchain & Cryptocurrency Regulation 2025 – Global Legal Insights. Greenberg Traurig. https://www.gtlaw.com.au/insights/global-legal-insights-blockchain-and-cryptocurrency-regulation-2025

Marketing Blockchain. (2024, June 6). Layer 1 Blockchain: The Foundation of Decentralized Networks. Medium. https://medium.com/@marketing.blockchain/layer-1-blockchain-the-foundation-of-decentralized-networks-4db09094fef9

ProShares. (n.d.). BITO: Bitcoin Strategy ETF. https://www.proshares.com/our-etfs/strategic/bito

Programming Insider. (2023, May 4). Understanding VeChain’s Blockchain-Based Supply Chain Management. https://programminginsider.com/understanding-vechains-blockchain-based-supply-chain-management/

Reuters. (2025, January 9). Dubai Developer DAMAC Signs $1 Billion Deal with Blockchain Platform MANTRA. https://www.reuters.com/technology/dubai-developer-damac-signs-1-bln-deal-with-blockchain-platform-mantra-2025-01-09/

Reuters. (2025, February 6). Franklin Templeton Seeks SEC Approval to Launch New Crypto Index ETF. https://www.reuters.com/technology/franklin-templeton-seeks-sec-approval-launch-new-crypto-index-etf-2025-02-06/

TradingView/CMC Markets. (2024, October 16). Institutional Adoption of Bitcoin. https://www.cmcmarkets.com/en-au/stockbroking/learn/investing-101/institutional-adoption-of-bitcoin

U.S. Council on Foreign Relations. (n.d.). The Crypto Question: Bitcoin, Digital Dollars and the Future of Money. https://www.cfr.org/backgrounder/crypto-question-bitcoin-digital-dollars-and-future-money

Zawya. (2025). UAE-founded DAMAC Properties Announces Aggressive APAC Expansion Plan with Latest Office Openings in Singapore and Beijing. https://www.zawya.com/en/press-release/companies-news/uae-founded-damac-properties-announces-aggressive-apac-expansion-plan-with-latest-office-openings-in-singapore-and-beijing-p9zrlfjx

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.