The idea for Twitter is believed to have incubated during a day-long brainstorming session at the podcasting company ‘Odeo.’ Jack Dorsey, along with Odeo’s co-founders Noah Glass, Biz Stone, and Evan Williams, initially designed Twitter as an internal service for Odeo employees. Its early success eventually led to it being publicly available as Twitter.com on July 15, 2006.

The app surged in popularity at the South by Southwest Interactive (SXSWi) conference. During the event, Twitter usage increased from 20,000 tweets per day to 60,000, thanks to an ingenious marketing stunt carried out by the team. Two 60-inch plasma screens placed in the conference hallways screened Twitter messages, allowing conference-goers to keep tabs on each other through tweets.

The company witnessed rapid growth as it reached 100 million active monthly users by September 2011 and surpassed 200 million active monthly users by December 2012 (CNBC, 2022). Simultaneously, the interface was completely overhauled to allow users to view pictures and videos on the app itself using embedded links to supported platforms such as YouTube and Flickr. The ‘New Twitter Experience’ also shifted the iconic ‘Retweet’ and ‘@mention’ features above the Twitter stream.

Post-2010, Twitter had firmly established itself as a prominent social media channel for disseminating information at a pace faster than traditional media outlets and free from censorship. Notably, in 2011, the Arab Spring saw the site being used by protestors to share breaking news, post reports, and organize protests (Al-Jazeera, 2021).

Twitter went public in November 2013. Trading under the stock ticker TWTR on the NYSE, the IPO was priced at $26 per share. However, trading opened on the day at $45.10 before reaching a high of $50.09, only to end the day at $44.90, valuing the company at $41.09 billion. On April 14, 2022, business magnate and investor Elon Musk announced his intention to purchase Twitter at a buyout offer of $44 billion or $54.20 per share – a 64% premium over the current trading price of Twitter stock at the time. the process of this acquisition as well as the implications of Twitter’s rebranding will be explored throughout this article.

Corporate privatization occurs when publicly owned companies become privately held (Silver, 2023). To make a company private, investors typically offer shareholders a premium over the company’s current trading price to induce them to relinquish ownership. Once a public company is delisted from primary and secondary markets, its shares can no longer be traded publicly. Additionally, private companies are not required to file disclosures with government bodies and are not as closely regulated by the government compared to public companies.

Elon Musk first started purchasing shares on January 31, 2022. By April 4, 2022, he had acquired 9.2 percent of the company, making him the largest shareholder. The market perceived this positively, with the stock rising 27 percent, the largest intraday surge following its IPO. On the advice of Twitter’s Nominations and Corporate Governance committee, Musk was invited to join its board of directors. Although Musk had initially accepted the position, by April 11, his narrative had changed. He posted a series of negative tweets and later announced that he would rescind the invitation to join the board.

On April 14, Musk made an unsolicited and non-binding offer to purchase the company at $54.20 per share, valuing the deal at $43 billion – a 64% premium over Twitter’s trading price then (Gordon, 2022). The deal was financed by a consortium of investment banks, including Morgan Stanley, Bank of America, Barclays, MUFG, Société Générale, Mizuho Bank, and BNP Paribas. The deal included $19.25 billion in debt secured by $62.5 billion of Tesla stock held personally by Musk. Furthermore, it also included $20 billion in cash equity through the sale of Tesla shares held by Musk, plus $7.1 billion in equity from seven independent investors (Australian Financial Review, 2022).

The offer was met with resistance by Twitter’s management, who adopted a poison pill strategy to counter the takeover, which they categorized as ‘hostile.’ On April 25, Musk’s ‘best and final offer’ of $44 billion was unanimously accepted with a buyout offer of $54.20 per share (Wile, 2022).

A month later, Musk decided to place the deal on hold, citing spam accounts making up a large proportion of Twitter’s user base, before announcing his intention to terminate the acquisition in July (BBC, 2022). In response, Twitter launched a lawsuit against Musk, on grounds that Musk manipulated the market. Finally, on October 3, Musk revitalized the bid on the condition that Twitter dropped its lawsuit, and on October 27, both Musk and Twitter completed the deal, with Musk becoming the owner of Twitter and assuming the position of CEO.

As a result of closing the acquisition and taking Twitter private, Twitter’s stock stopped trading on the NYSE, and a majority of shareholders were paid $54.20 for giving up ownership in Twitter, a price Twitter shareholders concordantly approved by a 98% margin. While shareholders were well compensated for Twitter’s privatization with a 64% premium, the implications of privatization are far-reaching and broad.

By taking Twitter private, Musk has more internal control over the company, as his power is not constrained by a board of directors or performance rules. With fewer outside shareholders, Musk does not have to worry about the effects of his decisions on public share prices. This means that Musk has more complete control over Twitter and can pursue the structural changes that he personally sees fit.

Upon becoming Twitter’s new owner, Musk dissolved Twitter’s board of directors and fired key executives, such as Twitter’s CFO and general counsel, instead of allowing them to voluntarily resign. This was based on the claim that they had misled him and Twitter investors regarding the number of spam accounts on the social media platform (Dang and Roumeliotis, 2022). Furthermore, in his first weeks as Twitter’s new owner, Musk reportedly ‘slashed’ half of the company’s workforce of 7,500 in an effort to cut labor costs, as, according to Musk, the company was losing $4 million a day (Bogage, 2022).

One of the leading reasons for Musk’s privatization of Twitter is that it allows him to pursue a vision of an “everything app” without public scrutiny and the need to disclose financial reports. His vision: an app that has instant messaging, social media, and the ability to conduct financial transactions online. To progress this vision, Musk merged Twitter with X Corp, a subsidiary of X Holdings Corp, which is a corporate entity entirely owned by Musk.

Part of this rebranding stems from Musk’s fondness for the letter X, a letter that has solidified itself throughout his commercial career in previous and existing business ventures (X.com and SpaceX). The letter X has appeared in Tesla, with the Model X vehicle, and is also the name of his son. More importantly, the rebranding stems from Musk’s keenness to create an everything app, with the acquisition of Twitter accelerating that vision.

The implications of the company’s decision to rebrand and replace its iconic “blue bird” logo with a minimalistic, uninspiring “X” have had significant and detrimental financial impacts. This change has also led to the complete erasure of the popular culture associated with the original brand name. The brand name “Twitter,” along with the company’s logo, was an essential internally generated intangible asset that created value for the firm, solidifying its consumer base and recognition within the industry. Twitter’s influence extended beyond finances and marketability; it was deeply ingrained in “Gen-Z/Millennials” society and culture. Its powerful brand image was evident through its influence on contemporary slang. “To tweet, to retweet” made Twitter more than just a brand name; it turned “Twitter” into a verb, synonymous with being a source of instant information – setting it apart from all other social media platforms (Radha, 2023).

Rebranding “Twitter” to “X” represents a dangerous and controversial shift, essentially eroding its consumer brand equity. The erosion of such a vital asset poses immense threats to X’s stability, with implications that extend from potential declining consumer engagement to falling advertising revenue and deteriorating shareholder value.

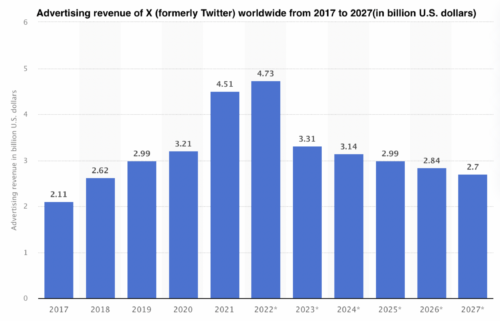

X predominantly generates revenue through advertising and data licensing, earning approximately “$4.5 billion from advertising and $570 million from data licensing” in 2021 (Cuofano, 2023). Therefore, the rebranding of Twitter to X would have caused significant damage to the company’s primary revenue stream. As a consequence of Musk’s bold yet contentious decision to rebrand “Twitter” as “X,” the company experienced an overall decline in advertising revenue, dropping from 4.73 billion U.S. dollars in 2022 to 3.31 billion in 2023 – a 1.42 billion dollar decrease, with further expected declines in the future (projected to reach 2.7 billion U.S. dollars by 2027) (Dencheva, 2023). The decline in ad revenue is unsurprisingly associated with an estimated loss of brand value ranging from $4 billion to $20 billion, as advertisers, concerned about Musk’s “courting of controversy,” have withdrawn (Counts et al., 2023).

Source: Statista, 2023

Musk attempted to offset this revenue decline by introducing subscription fees to access the platform, arising from the current advertiser boycott and the added distrust in Musk’s leadership. This substantial drop in advertising revenues has prompted Musk to explore the prospects of a paywall aimed at the app’s 550 million monthly consumer base, with the goal of replacing advertising revenue as the app’s primary source of income (Milmo, 2023).

Musk’s decision to replace the iconic blue bird with the plain black and white “X” logo is likely to lead to several lawsuits regarding the logo and its similarities with those of many smaller firms. According to trademark attorney Josh Gerben, “There is a 100% chance that Twitter is going to get sued,” as the “X” logo is shared by nearly 900 active U.S. trademark registrations (Jackson, 2023). Given Musk’s reputation and “deep pockets,” along with the understanding that most litigation cases are dropped when one party outlasts the other financially, Musk is highly likely to prevail (Jackson, 2023). However, Musk may potentially face litigation from his biggest competitor, Mark Zuckerberg. Both Meta and Microsoft already own trademarks for their own “X,” related to software within Facebook and Xbox gaming consoles, respectively, making “A legal battle over the intellectual property rights to X may be inevitable” (Jackson, 2023). Nonetheless, Musk’s already deteriorating reputation among advertisers, consumers, and investors is expected to take the biggest hit.

Furthermore, as Musk aims to position X as an “everything app,” offering services such as messaging, payments, flight bookings, and gaming, to emulate the Chinese app WeChat (Ray, 2023), the Meta-owned app “Threads” is increasingly seen by some as a “Twitter-clone” (Jackson, 2023). Although Threads is a relatively new app, it appears to have sufficient potential to compete over time with its competitor, aiming to exploit user dissatisfaction stemming from X (Wright, 2023). The app was the fastest to reach 100 million users (in five days) but experienced lower consumer engagement following the initial enthusiasm (Zahn, 2023).

X’s journey towards becoming a ‘super-app’ hasn’t been as smooth as Elon had hoped. The company witnessed a significant exodus of its most prominent advertisers, partly due to the radical changes occurring in the company after the takeover. Although Musk attributes the decline to activists, claiming they have exerted undue pressure on brands to boycott the platform, the company now faces significant financial and legal risks. Perhaps, the charismatic Elon has finally encountered a challenge with a decrease in firm revenue, compounded by the emergence of competitors.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.