As Australia grapples with the challenges of creating a climate-neutral economy by 2050, there has been increasing interest in how Australia can reduce its environmental footprint. At the forefront of this interest are electric vehicles (EVs) – automobiles that are powered by electric batteries, that on average, produce less emissions per kilometer than standard fossil-fueled vehicles. As EVs propose a solution to decarbonise Australia’s road transport sector, the domestic electric vehicle market has seen rapid growth, with sales in the first half of 2023 exceeding the entirety of 2022. Indeed, the surging demand for EVs in recent years, seen by the exponential uptake of new EV models, shed light on the shift in consumer sentiment towards EV’s and away from conventional vehicles.

In spite of this however, the burgeoning demand faces constraints. While the industry is booming, there has been a limited supply of affordable electric vehicles, potentially due to a lack of national policy surrounding the sourcing of such vehicles. Furthermore, on a global level, Australia’s public charging infrastructure severely lags behind its international peers, whereby Australia has three times the number of EV’s per public charging port compared to international standards. Consequently, the adoption of EV’s, though growing exponentially, are not maximised due to declining consumer confidence stemming from inadequate public charging infrastructure. This ultimately reduces consumer spending due to concerns about the range and accessibility of EVs.

While it is undeniable that electric vehicles provide a multitude of environmental benefits, they also have the potential to strengthen or worsen the economy. For example, in a recent study conducted by the Australian Parliament House, it was found that once purchased, the high capital cost of electric vehicles were offset by lower life-cycle costs. Furthermore, it was found that when monetized, the increased energy efficiency and greater environmental sustainability of an electric vehicle make them more cost efficient. However, despite these potential benefits, EV’s may place unprecedented demand on the economy due to the displacement of petroleum as a fuel source, and the expanding market threatens to reduce Australian employment and worsen underemployment in the auto sector. The transition to electric vehicles in Australia has raised many questions regarding the government’s ability to incentivise and support electric car ownership through policy.

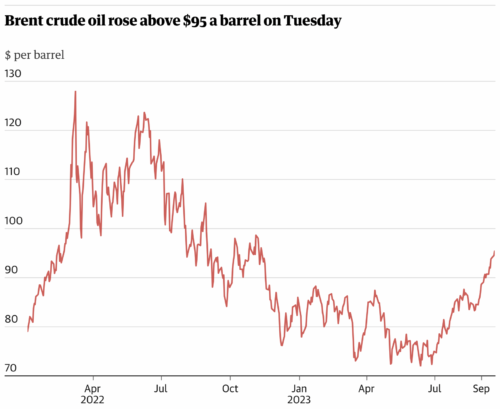

As global demand for electric vehicles (EVs) continues to surge to record highs, the concurrently rising global oil prices appear to be of predominant influence. With around 10 million EVs sold in 2022, global sales of EVs have risen by almost 35% to a record high of 14 million in 2023 – while sales doubled from 44,000 in 2022 to roughly 83,000 in Australia alone. On the other hand, tying in with current threats of inflationary pressures looming over the Australian economy, crude oil prices have risen to above $95 a barrel, stemming from recent supply deficits faced by Saudi Arabia and Russia. The rising prices of crude oil have resulted in “drivers (being) lashed by a 10p-a-litre rise in the cost of petrol since the beginning of August”, according to Luke Bosdet, the AA’s spokesman on pump prices.

Interestingly, as the popularity of electric cars continues to grow exponentially every year, the overall impact of rising pump prices appears to be linked directly to the simultaneously rising demand for EVs across the Australian and global economies. Furthermore, prices of electric cars have also recently appeared more appealing as Australia experiences healthy developments in the second-hand electric car markets and improvements in various other brands offering lower prices and healthy batteries. The long-term reliability of electric cars reflected through their resilience against the impacts of rising oil prices combined with the rapidly developing electric car market may, therefore, reflect the predominant driving force behind the increased demand for EVs in both domestic and global markets.

Source: The Guardian

While electric car sales accounted for 8.4% of new car sales in Australia in 2023 – this statistic has more than doubled since 2022, where EV sales accounted for only 3.8%. Sales of EVs within the first half of 2023 have already exceeded last year’s annual total sales, hence further emphasizing the extent of the growth in demand for EVs within the Australian economy. Another possible factor influencing this growth in demand may stem from shifts in contemporary consumer interests and values. While in the past, most consumer choices were determined mainly by brand names and other superficial factors, with increasing awareness in the scopes of climate change and environmental degradation, more consumers prioritize the environment and sustainability as bearing greater importance.

The desire of modern consumers to push the Australian economy towards its targets – to cut emissions 75% by 2030 – is evident as new electric cars reportedly sell out within hours of coming to the market. As EVs typically generate the same greenhouse gas emissions as a car, getting 88 miles per gallon, the country’s carbon footprint may be reduced significantly. Although emissions from the manufacture of EVs are significantly higher than that of regular car production, such consequences are offset by the reduction in subsequent greenhouse gas emissions once the vehicle hits the road. This shift promotes cleaner streets, lesser air pollution and contributes to an overall healthier environment. As a Victorian government spokesperson stated, the economic shift towards electric car usage would also allow “all road users to pay a fair share towards the cost of maintaining the road network”. Therefore, the overall increase in awareness associated with environmental conservation and minimizing pollution contributes significantly to the rising demand for EVs in Australian and global economies.

Source: The Driven

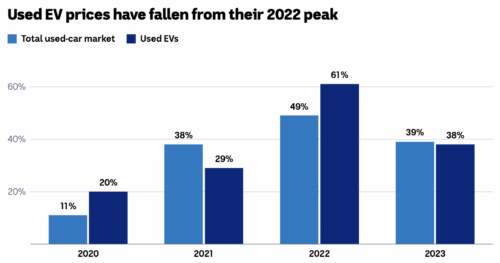

The price of EVs in Australia has remained expensive for both new and used vehicles. It is interesting to note that second-hand EV prices do not follow commonly seen price movements driven by scarce supply and the rapidly changing nature of EV technology. Internal combustion engine vehicles (ICEVs) typically depreciate by almost fifty percent within 3 years, whilst an EV depreciates at a slower rate. With car dealers characterizing the wait times on EV deliveries ‘extremely long’, a shortage of vehicles on the market coupled with the slower depreciation rates on the vehicle contribute to the persistence of comparatively higher prices.

Source: ABC News

Although used EV prices have generally followed the trends of the used car market, they tend to exhibit more volatility, making prices unpredictable. For instance, prices surged significantly in 2022 post-COVID, but then fell steeply by 23 percent in 2023. An underlying reason for this downward pressure on prices can be attributed to the introduction of government purchase incentives. Federal Government incentives encompass a higher Luxury Car Threshold (LCT), exemption from all custom duties, and exemptions from Fringe Benefit Taxes (FBT). FBT exemptions opens up novated leasing opportunities for employees, making EVs more affordable and fostering long-term demand. This, in turn, assists in addressing the shortage of EVs in the medium to longer term.

The US market is several years ahead in terms of EV usage and prevalence. This can partly be attributed to the fact that major EV manufacturers such as Tesla and GM having a sizable portion of their manufacturing operations on-shore within the country. Key policy measures such as the Inflation Reduction Act (IRA), Infrastructure Investment and Jobs Act (IIJA), and the US Environmental Protection Agency’s (EPA) proposed emission standards, have added momentum for the long-term transition towards electrified transportation.

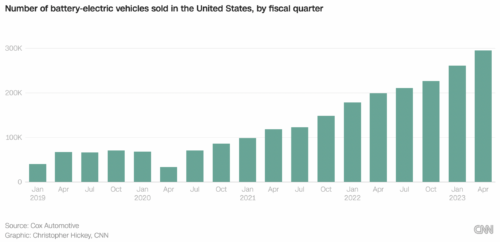

The IRA and IIJA have incentivized investments in EV manufacturing as well as the establishment of a national EV charging infrastructure network. Furthermore, the EPA’s emission standards for light and medium-duty vehicles have already had a sizable impact on EV sales, which have been further boosted by a nearly 30% reduction in prices compared to that of last year. The drop in prices is partly due to the increase in supply, with large previously leased vehicles hitting the resale market. Counterintuitively, it can also be attributed to the rapid advancements in EV technology, which stands in stark contrast to ICEVs. Thus, an EV today may represent greater value for the buyer in terms of performance than an EV manufactured a few years back. The culmination of a multitude of social, technological and political changes with regards to EV has led to impressive performance in the US market this year. Cox Automotive predicts that EVs will hit sales figures of 1 million units this year, with the first half of the year recording more sales than the entirety of 2019.

Source: CNN

An EV trailblazer in the APAC region has been Vietnam. It is estimated that the EV market in Vietnam will grow at a rate of 22.9% during 2020-2025, primarily fueled by the domestic EV manufacturer VinFast. Vinfast, which launched and sold its first electric car, the VFe34 ly in December 2021, has quickly risen to become one of the most valuable players in the market, trailing only behind Tesla and Toyota in terms of valuation. Global sales projections for VinFast indicate potential sales of over 50,000 units. Although these developments seem promising, it may be too early to brand the early achievements of Vietnam and VinFast as revolutionary.

As of 2023, the Australian government is in the process of implementing several new initiatives to expand the EV market and meet growing consumer demand. One of these initiatives is to increase the supply of affordable EVs through the implementation of a Fuel Efficiency (CO2) Standard which will encourage foreign manufacturers to export more fuel-efficient vehicles to Australia. Another initiative is to establish a national EV charging network to increase EV uptake, which will see the development of charging infrastructure installed at 117 sites on major regional highways. Alongside these initiatives, the Treasury Laws Amendment (Electric Car Discount) Bill, recently introduced in November 2022, will see the Australian government encourage consumer demand for EVs via sales rebates, and the removal of a 5% import tariff on electric cars sourced from foreign exporters. The combined forces of these initiatives are reflective of an increasing consumer sentiment surrounding the state of an expanding EV market, and presents an opportunity for the Australian government to boost economic growth.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.