An Initial Public Offering marks the moment a private company goes public, offering its shares to public investors. The history of IPOs is a tale of market resilience amidst economic turmoil, a reflection of industries undergoing transformation, and a testament to the intricate dance between capital allocators and market dynamics. Taking a look back at historical global IPO data, there is much to learn about such dynamics, offering insight into what the future may hold.

Resilience and Transformation: Decades of IPO Evolution

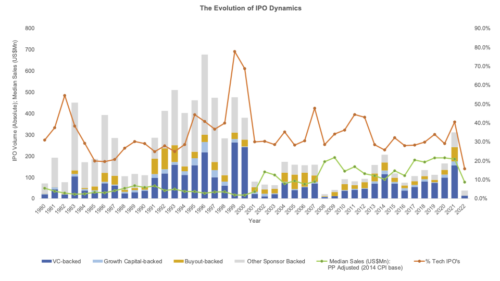

This journey, chronicled from 1980 to 2022, unveils trends that spotlight the endurance and adaptability of financial markets:

The IPO saga is intrinsically tied to venture capital (VC), a harbinger of innovation and risk-taking. As seen in the above chart, historical data showcases VC-backed IPOs as a robust force, even during economic downturns. During the dot-com crash of the early 2000s and the global financial crisis of 2008, VC-backed IPOs maintained a consistent presence, underscored by the fact that, in 1999, a staggering 64% of IPOs were venture capital-backed, marking the zenith of the tech bubble and hovering across 30-35% in following 5 years. Moreover, technology-oriented IPOs emerged as the beacon of change. As tech giants like Amazon and Google shaped industries, the late 1990s and the 2010s saw tech IPOs dominating the VC-backed segment. The message is clear: technology’s transformative power continues to dictate the IPO narrative.

Buyout-backed IPOs tell a tale of private equity (PE) players navigating economic cycles with tactical precision. In periods of economic exuberance, PE firms orchestrate IPOs to monetise and cash out of investments. The late 1990s witnessed a surge in buyout-backed IPOs, riding high on booming markets. However, the financial crisis of 2008 led to a dip in buyout-backed IPOs, revealing PE’s vulnerability to market fluctuations. Case studies underscore these dynamics where Facebook’s 2012 IPO showcased tech’s soaring prowess, while private equity-backed HCA Healthcare’s IPO delay during the GFC highlighted PE’s caution during uncertainty.

Beyond the numbers, median sales values reflect the pulse of the IPO market. The dot-com euphoria of the early 2000s is mirrored in soaring median sales values, while the aftermath of the 2008 crisis is evident in a dip, reflecting cautious investor sentiment. However, 2022 raises intriguing questions. The decline in VC-backed IPOs and tech’s diminished share begs analysis. Is this an anomaly, or a harbinger of change shaped by evolving regulations and investor sentiments?

Driving Forces Behind a Resurgence?

Given the recent history of IPO markets, the drought of high-quality tech IPOs over 2022 has likely left venture capital firms with a significant amount of capital that is now demanding distributions. Between 2013 and 15, venture capital firms have raised $204bn in fresh capital. As these funds are often constructed with a 10-year lifespan, it is likely that most of the investors in these funds are now requiring distributions of this invested capital. Due to the material markdowns suffered by these venture funds on the rest of their portfolios, distributing capital from their key winners has become even more of a priority. Therefore, VCs will likely flood in with key IPO candidates at the first sign of life in the public markets and the receptiveness for key IPOs.

The second key factor driving IPO volumes over the second half will likely be the rebound of public markets in 2023. With the NASDAQ up 31% YTD, investors have returned to look for growth stocks after the pressure on growth valuations over 2022. Moreover, various private companies are playing into the key themes that investors in public markets have been searching for exposure to. This includes chip designer ARM looking to go public while transitioning from smartphone chip design to a focus on AI, competing with the likes of Nvidia and AMD. Given the likely discounting of the earlier IPOs to ensure strong buyer interest, ARM could present an opportunity for investors to gain exposure to the AI thematic at a more attractive price than Nvidia’s 57x 1-year forward earnings (as of Aug 2023).

Finally, IPO markets now have become one of the only viable sources of large exits for investors. The crackdown of regional competition committees on corporate takeovers has largely removed the major players from buying out start-ups to give key investors a payday. Gone are the days where incumbents such as Meta and Google could provide VCs investing in unprofitable start-ups a clear path to achieving an exit, as occurred with WhatsApp and DeepMind. ARM itself is a casualty of this more aggressive regulatory environment, with the FTC forcing Nvidia to terminate its proposed acquisition in 2022. Given that the large, cashed-up balance sheets of big-tech firms are no longer as much of an exit opportunity, the IPO market remains increasingly important for start-ups today.

What the future holds:

There is a compelling case for an imminently hot IPO market, underscored by the convergence of the speculative frenzy surrounding AI, and VC firms’ desire to exit and return cash to investors. Despite the uncertain macroeconomic outlook, the proliferation and popularity of Large Language Models (LLMs), such as OpenAI’s ChatGPT, has caused a 224% YTD surge in NVIDIA’s share price which has largely fuelled the NASDAQ’s 31% YTD rise. This has seen an increasing number of firms name-drop AI in their earnings calls in an attempt to ride the AI wave. Many are poised to capitalise on this AI hysteria, including Japanese VC firm SoftBank set to take the aforementioned British chipmaker ARM public in September 2023 at a proposed valuation of 50-60b USD.

However, this all this sits amidst the backdrop of a more uncertain macro economic environment, one which makes alternative investments for more attractive than they otherwise would be. Money market funds (MMFs), which pool investors’ capital to invest in safe short-term assets such as bonds, experienced significant inflows in the first half of 2023 and are sitting on record levels of assets. Outflows from MMFs (following substantial inflows) historically occur following sizeable interest rate cuts, but recent words from US Federal Reserve Chair Jerome Powell propound the likelihood of higher rates over a longer time horizon. Despite this, the year-to-date rebound of equities (specifically in tech) may prove to be a catalytic driver of outflows and an exception to the rule.

An environment of high interest rates, risk-aversion, and macroeconomic uncertainty, poses a challenge to a reversal in IPO volume to the upside. Yet, the technology sector’s YTD advance, propelled by the emerging AI market thematic, in conjunction with record levels of retail investors’ cash holdings, has the potential to overpower the traditional procyclical trend of IPO volume.

Conclusion

The IPO landscape is a chronicle of economic epochs, technology revolutions, and investor preferences. From venture capital’s audacity to technology’s endurance and private equity’s dance with market cycles, IPOs paint a vivid portrait of financial evolution. History shows that IPOs are not just transactions, but pivotal indicators of economic paradigms. As we decipher this narrative, we realize that the IPO journey continues to illuminate the ever-shifting contours of finance, industry, and innovation.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.