Monetary Control and its Implication to Decentralised Finance:

Under modern macroeconomic systems, central banks play a key role in influencing the economy by controlling the money supply in addition to fiscal/budgetary policy. The RBA performs open market operations in the Short-Term Money Market to set the cash rate which in turn influences interest rates. Changes in interest rates impact the economy through 5 channels: savings and investment, cash flow, availability of credit, exchange rate movements and asset prices.

Many purveyors of Decentralised Finance products such as Cryptocurrencies and NFTs are sceptical of both current financial institutions and the products and services they offer, and the way central banks operate. Decentralised finance seeks to eliminate hypothesised inefficiencies created by these intermediaries and circumvent the absolute control central banks have over the money supply. Decentralised Finance therefore would influence the transmission mechanisms of monetary policy.

As is the case with most issues, monetary control/policy has both positive and negative implications. An understanding of these issues in light of the way monetary policy operates would help one make sense of these myriad critiques. This would enable a more economically sound and rigorous examination of the current financial system which helps to shed light on the efficacy of decentralised finance in counteracting the shortcomings of the current financial system.

A common critique of central banks is that they “[prioritise] the preservation of the value of money over the monetary needs of a sound national economy”.

Others question whether central banks operate with absolute political independence as, for instance, the Board of Governors of the Federal Reserve are appointed by the United States President and confirmed by the Senate. Many would agree that central banks should not be controlled or influenced by governments because if so, they would have an incentive to conduct monetary policy in a manner favourable to short-term partisan interests but to the detriment of the long-term economic interests of the country. Interestingly, there is empirical evidence that the macroeconomy operates on a political business cycle. A government-controlled central bank would accentuate this phenomenon.

The US Federal Reserve also received criticism for the way they during both the 2007-08 Financial Crisis, with some partly attributing the financial crisis to a lax cash rate targetLikewise, they received backlash for “propping up financial markets” during the COVID-19 recession

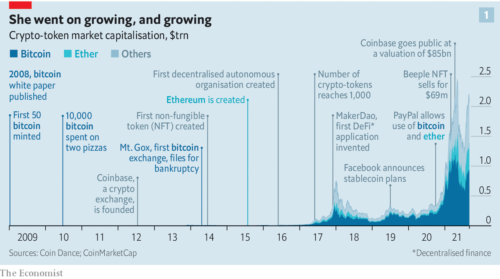

Some believe that cryptocurrency will replace the conventional system of fiat/electronic money. To make sense of that proposition, consider that money currently has three key functions; it is a medium of exchange (utilised for payments), a unit of account (a measure of value) and a store of value and purchasing power. Central banks conduct monetary policy partly to ensure the utility of money in these regards. Given that the third function (store of value) arguably less persistent than the first two due to the impact of inflation, do cryptocurrencies do any better? Firstly, cryptocurrencies, such as Bitcoin, are a viable medium of exchange; there are low fees associated with cryptocurrencies compared to conventional counterparts such as credit cards. Further, Bitcoin transactions are at the very least, pseudo-anonymous (transactions are potentially traceable). As a unit of account and as a store of value, Bitcoin does not hold up. The price of Bitcoin has been unacceptably volatile and uncertain compared to most conventional currencies. Hence, Bitcoin has difficulty in satisfying those two conditions. Hence, as it stands, Bitcoin fails as a medium of exchange.

Furthermore, in the crypto space, there are also financial instruments known as stablecoins which are cryptocurrencies whose value is pegged to another asset. When the pegged to a reputable fiat currency, both unit of account and store of value functions would be satisfied. Stablecoins maintain their peg via algorithms and/or they can hold reserves in the asset they are pegged to. An intriguing recent event with a stablecoin Terra USD (UST), with rapid withdrawals highlighting the systematic risks innate to algorithmic stablecoins.

All central banks aim to achieve monetary and financial stability. Many central banks have a primary objective of maintaining a certain average inflation rate over time. For instance, the RBA seeks to meet a 2-3% average inflation rate over time. Secondarily, they also attempt to address real GDP growth and the unemployment rate.

The main upside to monetary control is its ability to inflation-target which can be a powerful tool for influencing aggregate demand as well as other key economic indicators, through the 5 aforementioned mechanisms. However, this relies upon the central bank having control over the money supply; taking away from this control will vitiate this capability. Monetary policy has empirically shown to be an effective means of restraining aggregate demand during booms which also has a short implementation lag compared to fiscal policy since the RBA has monthly meetings to determine the target cash rate. Furthermore, as stated earlier, central banks are able to operate free from political interference.

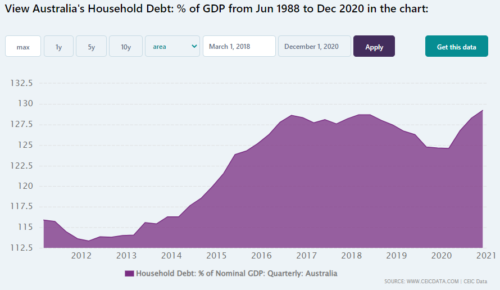

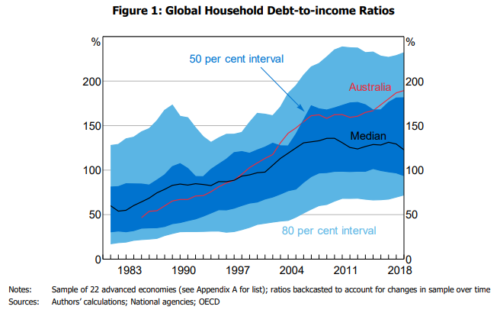

However monetary policy is far from the perfect tool for influencing the macroeconomy. Monetary policy is fundamentally a blunt instrument, because interest rates do not differ significantly from one industry or geographic location to another. For example, during the mining boom in 2003, the RBA was unable to simultaneously prevent the mining sector from overheating while stimulating the rest of the economy. Furthermore, there is empirical evidence suggesting an impact lag of 5 quarters when deploying countercyclical monetary policy (Paskelian, Bell & Nguyen, 2011). Additionally, some question the effectiveness of monetary policy when there are high levels of household debt. The problem of household debt is particularly pronounced in Australia, and hence Australians may respond inelastically to changes in interest rates. This is an additional consideration the RBA must take into account.

Moreover, central banks do not have direct control over interest rates. The oligopoly dominating the Australian banking industry – the Big Four banks (CBA, NAB, Westpac and ANZ) – are estimated to hold a combined market share of over 80%,. Low competition implies that these banks may have not passed cash rate cuts, via interest rates, to customers to the extent expected by the RBA. Additionally, in 2011, the Big Four banks are also estimated to hold 82% of all loans in Australia – a disproportionately large figure.

Disadvantages of monetary control and the current centralised financial system

The Greek Debt Crisis serves as a real-life horror story into the extreme though unlikely financial restrictions a centralised financial system can place on individuals. In attempting to rectify their economy amidst the Greek government-debt crisis, the Greek government, limited cash withdrawals (€60/day), prohibited international capital movement and confiscated funds from citizens’ bank accounts. Cryptocurrencies reduce both transaction fees and waiting times for the movement of capital funds for domestic and international transactions. Moreover, with few regulations on cryptocurrencies, there are few restrictions on capital mobility – a potential avenue of reducing wealth inequality.

Furthermore, during period of inflation, especially hyperinflation, fiat/electronic money lose their purchasing power since prices levels are higher. Cryptocurrencies provide a potential solution to this issue; because Bitcoin and other cryptocurrencies have an algorithmically limited or fixed supply and thus can be classified as deflationary assets. However, while the US are currently experiencing their highest inflation rates since the 1980s, cryptocurrencies remain volatile and are in fact falling in value. However, it would be dishonest to attribute that all to inflation since asset prices are plummeting across the market.

Why is there a need for decentralised finance?

The conventional banking system requires extensive infrastructure to maintain trust in transactions. They require resources such as clearinghouses, compliance, capital regulations and courts. Hence, this current system is expensive for consumers while lucrative for insiders such as credit card service providers or bankers. Card network operators such as Mastercard and Visa make gross profit margins of 60-80% (Economist, 2021).

Furthermore, the trusted financial institutions are often private and operate as monopolies, “enforcing anti-competitive behaviour and rent extraction” (Economist, 2021). Concerns about the impact of this kind of market power can be seen in the behaviours of tech giants. For instance, Youtube has full discretion in deciding when to demonetise content creators; Apple changed how its operating system facilitates third-party software to stop Facebook trackers.

The idea of decentralised finance (DeFi) showcases the potential for a new system that is more trustworthy, cheaper and faster than the current one. In contrast to the oligopoly of the Wall Street titans, DeFi seeks crowdsourced control. Applications are run by user-operated and decentralised autonomous organisations as opposed to a single centralised company.

The existence of DeFi relies on the technology of blockchains which comprise vast networks of computers that keep an open, incorruptible common record that is constantly updated without the presence of a central authority (Economist, 2021). This makes it possible to construct smart contracts that are automatically enforced and can’t be interfered with. In essence, a blockchain is “a virtual computer that runs on top of a network of physical computers” (Dixon, 2021).

Traditionally, every computer outside a blockchain is controlled by a person or organisation that can radically change their policies and behaviour. This is evident in how Apple changed its policy to neuter Facebook trackers. However, this relationship is inverted on the blockchain since the software governs the hardware and can make guarantees. Therefore, once a decentralised foundation to store and execute code has been created, digital assets or applications can be built on top. Some of these digital assets include non-fungible tokens (NFTs), stable coins and tokens that resemble financial building blocks like shares and bonds.

Leading blockchains

Many functions of the financial systems are recreated as applications and protocols — the rules that govern how transactions take place — on the Ethereum blockchain, an open blockchain that can store and verify lines of code.

The openness of the blockchain network is a key source of trust for users. As a result, the value of Ethereum grew from almost nothing in early 2018 to a total market value of 90 billion dollars in 2021. Further, it has verified 2.5 trillion dollars’ worth of transactions by end of the second quarter of 2021 which is around the same sum that Visa processes.

There are many other innovations such as automated market makers, arbitrage systems and self-stabilising currency regimes that developers are currently working on that revolutionise the financial technology sector.

What are the downsides?

There are still plenty of obstacles standing in the way of a Utopic DeFi future. The most common criticism is that blockchain platforms cannot be scaled easily since computers consume excessive amounts of electricity. By 2021, the Cambridge Center for Alternative Finance (CCAF) estimates that Bitcoin currently consumes 110 Terawatt Hours per year which is 0.55% of global electricity production, or roughly equivalent to the annual energy consumption of small countries such as Malaysia or Sweden (Harvard Business Review, 2021).

However, it is unclear whether the energy consumption is necessarily increasing Carbon Emissions. Reports in 2019 suggest that “73% of Bitcoin’s energy consumption was carbon-neutral due to the abundance of hydropower in major mining hubs such as Southwest China and Scandinavia” (CoinShares, 2019).

There are also worries about how a virtual economy with its own rules interacts with the real economy. Firstly, there lacks an external measure of value because cryptocurrencies fully rely on the market’s shared expectation of their utility. Secondly, cryptocurrencies are not backed by authorities and state lenders in a way that conventional money is. The absence of central players makes DeFi vulnerable to market panics, thus contributing to extremely high volatility — it seems inconceivable to operate a DeFi system when the underlying currencies are unstable in value. Thirdly, the enforcement of smart contracts outside the virtual world is problematic for, in reality, only the enforcement authorities can execute terms and conditions. For instance, if an individual purchased a house through a housing contract NFT, it is unclear how the real-world authorities can enforce the contract and evict the current residents.

Additionally, although DeFi takes pride in its transparency, it still faces the challenge of governance and accountability. Three issues need to be addressed: firstly, irrevocable large transactions that humans cannot override could be dangerous, secondly, financial criminal activities like money laundering thrive in the decentralisation banking system via cryptocurrencies such as Ethereum. Thirdly, some programmers hold disproportionate influence over the DeFi system.

The possible impacts of DeFi on the current system

In recent years, the Decentralised Finance (DeFi) market has grown exponentially. DeFi rapidly garnered popularity since it provides a quicker, cheaper and more secure alternative way to execute transactions via smart contracts. According to a new research report, the total value of DeFi increased nearly 40000%, from $601 million at the start of 2020 to $239 billion so far in 2022. As such, DeFi has the potential to shake up the current financial system, transforming it into a more equitable, accessible and innovative one.

Stable coins

One of the ways in which DeFi seeks to improve the current financial system is through the utilisation of stable coins. Stable coins are designed to track the value of an underlying asset, such as a fiat currency like the USD, or a commonly traded commodity such as gold. Thus, owning a stable coin allows investors to reap the benefits of the blockchain technology while minimising the volatility and risks associated with crypto assets. Further, staking stable coins, which means locking them away from a period of time, often provides investors with lucrative interest rates which makes them a popular choice for a theoretically risk-free investment.

The values of stable coins are pegged to the underlying asset through two mechanisms. First, through collateralisation. This means the tokens are collateralised by an equivalent amount of the underlying asset, allowing projects to quickly absorb the impacts of market disruptions and keep the exchange rate fixed. An example of a stable coin that is pegged to the USD through collateralisation is Tether (USDT), which claims to have enough supply of USD to back its tokens in circulation. Other tokens are algorithmically pegged through smart contracts. This means the tokens are backed by an on-chain algorithm that monitors the demand and supply of the stable coin and another token, which then artificially adjusts the demand and supply in response to market disruptions in order to keep the exchanged rate pegged. An example of an algorithmically pegged stable coin is TerraUSD (UST), which maintains its value through an arbitrage mechanism between itself and its sister token, Terra (LUNA), as shown in the diagram below.

While collateralised tokens continue to perform consistently, algorithmically pegged tokens, namely UST/LUNA, has shown its vulnerability and incapability to respond effectively to sudden market disruptions, causing it to lose its peg to the USD and its price to freefall. Fundamentally, stable coins provide ease and safety of access to the decentralised financial markets, with the rapid digitalisation of assets, they could prove to be a viable substitute to fiat currencies.

CBDCs

With stable coins becoming increasingly lucrative as an investment choice, governments have responded by creating their own versions of digital currency – the Central Bank Digital Currencies or (CBDCs). The purpose of CBDCs is to provide convenience and security to users while maintaining the status quo of currency oligopoly in a centralised economy. Akin to stable coins, CBDCs are pegged to a country’s fiat currency, thus carrying the same values as their fiat counterparts. As opposed to stable coins, CBDCs operate in a centralised version of blockchain network under the government’s surveillance, which makes it incredibly easy to track funds and prevent financial crimes. As such, should CBDCs replace fiat currencies, governments would benefit significantly from the ease of financial regulation.

Additionally, CBDCs have also been developed by countries such as China and Russia as a potential way to challenge the USD’s hegemony and soften the impact of potential economic sanctions imposed on them. For example, China has been exploring the possibility of cross-border payments with the digital yuan, in an attempt to internationalise its currency and curb the dominance of the USD in the current system. A digital yuan dominated financial system would be especially attractive to emerging economies. By making cross-border payments easier and cheaper, the digital yuan system provides a feasible alternative to developing nations that are held back by costly access to USD-based global payments but also want to reduce their dependence on the dollar for geostrategic reasons. As such, the successful development and implementation of CBDCs would serve as a significant challenge to the USD’s hegemony, thus making the financial system more equitable and accessible, especially for developing nations.

The development of the DeFi system has been exhilarating, and the blockchain network has the potential to make the current system fairer, simpler and safer. However, although the blockchain provides a platform for constant innovation and a possible revolution of the current financial system, the inherent risks and speculative nature of the market suggest that the DeFi space, as well as crypto assets, lack the capability to be a viable substitute to the current system, at least in the short run.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.