For those who don’t have access to the Bank of Mum and Dad, homeownership is becoming an impossible dream.

The housing market over the past two years:

Overall, House prices rose by 13.4% (inflation-adjusted) in 2021, to an average of $727,427, up from the previous year’s 8.7% increase. This is the highest growth rate recorded since 2010. Furthermore, rental yields are now declining across all Australian cities, with Sydney experiencing a record low rental yield of 2.56% in 2021. During this period, the interest rate hit a record low of 0.1%. In accordance with the 2021 Demographia International Housing Affordability report, Australia is “severely unaffordable” compared to 92 other countries. This is partly due to policies that have severely limited new housing construction beyond the urban fringe. Fewer than half of 25-34-year-olds own their own home. Particularly, Sydney is Australia’s least affordable housing market and ranked third least affordable globally. It is forecasted that by 2056, only 66% of retirees will own their own homes (down from 80%) today. Senior Australians who do not own a home are more likely to suffer financial stress.

Forecasts for the housing market in the next two years:

It is forecasted that property prices will continue to rise in 2022, but not as much as in the last two years, with a reduced growth rate predicted for 2023 which is due to two reasons. Firstly, pent-up demand is waning. Many people were rushing to purchase a home after the COVID-19 outbreak caused delays in home purchasing. This pent-up demand has since been acted on in 2021, resulting in present declining demands. In consequence, reduced demand reduces the price. Secondly, APRA is intent on slowing down our housing markets using macro-prudential controls. APRA is a financial regulator that protects the interests of depositors, insurance policyholders and superannuation fund members.

It is also forecasted that we will experience a “two-tier property market”, insinuating that not all suburbs will undergo identical growth rates. Middle and inner-ring suburbs will outperform outer suburbs, which were more adversely impacted by the effects of COVID-19. Rental yield is predicted to increase since the opening up of international borders, and the return of international students will increase demand for rental properties.

The Big 4 banks predict that house prices will rise in 2022 but fall back in 2023. NAB predicts a 4.9% lift in property values in 2022 and a 4% decrease in 2023, while the CBA expects house prices to rise 7% during 2022 and 10% the following year. Michael Yardney is regarded as Australia’s leading property investment adviser. He argues that “Australian banks don’t have a good track record of housing market forecasts; they tend to underestimate the strength and resilience of the housing markets”. He states that while interest rates are currently at a “stimulatory level”, they are expected to rise only slightly to “neutral levels” once the RBA deems the economy fit enough to handle a rise. While some commentators are concerned rising rates will cause mortgage defaults, Michael states that it is improbable that this will occur for the following reasons:

Furthermore, among America’s 40-year high inflation rate of 7.9%, rising global inflation and interest rate spikes, the Reserve Bank of Australia (RBA) continues to brush off inflation fears, insisting Australia’s economy is in a different position. RBA’s Phillip Lowe argues that inflation rates in the United Kingdom, Germany, Canada, and New Zealand are at their highest in decades. However, it is crucial to recognise that inflation rates in Asia remain low and non impacted by the pandemic. In China, CPI inflation is running at just 0.6%,and 0.5% in Japan. Australia sits somewhere in the middle but closer to the experience in Asia. Headline inflation here is 3.5%, less than half the rate in the United States.

Source: Reserve Bank of Australia

So, the question remains, is now a good time to invest in property? With the onset of global inflation, should Australians now buy houses before their money reduces in value and before interest rates rise? Can our student readership enter the property market early and get ahead? Below we provide you with some hot tips about entering the property market. We also investigate some of our government’s solutions to Australia’s severe housing unaffordability.

Another Perspective: The Australian Dream

The Australian dream has magnified the factors discussed above; a cultural phenomenon acknowledged even by the government. Australians want to have their own house; an aspect of Australia’s cultural identity dating back to the first waves of European immigration. This attitude – that to be Australian is to own a detached house – has permeated into official policy. Green wedges and urban fringes are areas of low urban development where no residential development can occur. Nonetheless, to keep pace with housing demand, these have been pushed out and rezoned into residential housing areas. This often outpaces critical infrastructure, which would explain the predictions above for why inner suburbs have house prices growing at a greater rate than those in outer areas. Wantonly increasing supply is not guaranteed to lower housing costs. Specifically, speculative investors in Sydney and the other regions have driven up prices for detached housing, and apartments are commonly regarded as a temporary step before families move into single-family dwellings. To recoup their increased investment, it is not difficult to imagine that this cost is passed on to other Australians through increased rent. Even for the Australians choosing not to dream, looking instead for apartments or housing further away from established population centres, housing remains an expensive necessity.

Missing Middle Housing

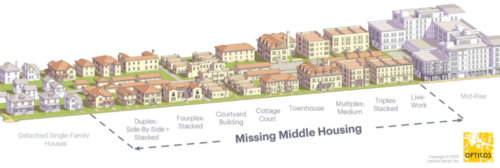

Measures to help Australians break into the property market are constantly fiercely debated. Some ideas even move beyond election promises and online vitriol, with the coalition’s first home buyer grant helping 60,000 Australians buy their first home. Some are calling for a more structural change to Australian housing – advocating the construction of what has been dubbed ‘Missing Middle Housing’.

Source: Missing Middle Housing

Missing Middle Housing (MM) refers to mid-density housing, the duplexes, cottage courts and multiplexes that have been pushed aside to favour apartments and detached houses. In the space typically occupied by one or two detached houses, these dwellings can provide accommodation for two or three times that number of people. While the concept has its detractors, moves by the government to approve projects in line with this philosophy could present a long-term solution to the supply issue that is inflating property prices.

Current Australian efforts to resolve MM fall short. The implications of a constructive attempt to establish MM, away from the property development attitude that sees apartments unliveable and current MM emerging as “detached housing-lite”, could rectify the issues we see in developing suburbs. MM lots built sustainably and concentrated in population centres already established with public infrastructure would imply local governments no longer need to catch up with sprawling needs. Current infrastructure could simply be improved further, with new homeowners no longer required to wait for necessities that go unacknowledged in pursuit of the Australian dream. Studies have shown MM to lower rental rates. A move to compromise with the vision of a quarter-acre property is a small price for Australia to begin its first steps to addressing the housing affordability crisis.

Potential Strategies/Tips to Help Secure a Home in Future

The challenges and restrictive government policies discussed above depict a rather stark perspective on investing and owning a property in Australia. However, a handful of potential strategies and helpful tips can help ease the path toward this vital factor of the “Australian dream”, particularly for the younger generation of home-buyers. Key among them are the first stages, including the search for the best property that suits your budget and ideal home and the securing of loans to go about this.

Firstly, the most significant aspect is determining a budget and the mortgage repayments expected for various amounts. It is also vital to consider the available deposit as this can affect the amount you can borrow; typically, lenders expect 5%-20% of the purchase price as a deposit. Moreover, it’s beneficial to compare how your needs and wants differ or correlate. For example, there may have to be a compromise between the size of your new house and its location, as it is rare to find an ideal property. Also, you may sometimes have to choose a smaller home due to affordability. Compact homes are recommended by real estate agents, particularly for first-time home-buyers, as they are often in better locations, are easier and cheaper to maintain and are more environmentally sustainable. Hence, adaptability is a crucial mindset when home-buying, especially considering the current state of the Australian housing market prices and fluctuations.

Furthermore, notable statistics when house-hunting would be the observed rental yield of the relevant or investigated area. Rental yield, essentially the gap between overall costs and gains from renting out your property, is a significant factor, particularly if you are hoping for enviable investment returns with the property you are considering. Because there has been an unfortunate depreciation of rental yields across most Australian cities (see above), it’s helpful to understand which suburbs offer relatively better rates than others. According to Corelogic, the suburb with the highest gross rental yield as of October 2021 was South Hedland, in Western Australia. Indeed, WA and Queensland suburbs dominated the rental yield report; only one suburb from Victoria qualified for this list, while NSW had 11 high yield suburbs listed. Additionally, house price growth rates are also helpful to consider; for example, the highest growth occurred in the inner city, water-front suburbs across NSW and Victoria, such as Point Piper and Lorne. Yet, prices are rising even in more generally affordable suburbs, as houses see more demand than units.

This brings us to the dilemma between investing in units/apartments or houses. Generally, units are a more affordable entry point into the housing market for first-home buyers. There are around $200,000 differences in costs between houses and units in Australia’s biggest cities. Historically, although houses have better success at attracting investors in terms of capital gains, there can be exceptions where apartments ascend to the same level of gains. Moreover, apartments have a better prospect of being rented out. Thus, it is suggested that the current housing sector is very tight and hostile to enter for first-time home buyers involving the younger generation. On the other hand, apartments/units are a better, more affordable option that can provide long-term gains that can be invested in future homes.

Source: Mashvisor

Another option is investing rurally. There is a range of benefits, such as rural property being generally unaffected by economic slowdowns, owners likely to hedge against inflation, and lastly, it is a socially responsible investment that can indirectly reinvigorate rural communities. It is a lot more affordable than city living, and as rural properties gain fame as the next investment frontier, long-term capital gains could become extremely appealing. Property prices are, as a whole, expected to fall in 2023, with some clamouring that 2022 is possibly the worst time to invest in a house. However, what expert Chris Gray recommended was to buy:

Conclusion

Australia’s housing market is under chokehold for many reasons, including COVID-19. Even though most Australian households are wealthier than ever before, there is still a significant obstacle to young people trying to buy homes for the first time. This deepens the inequality gap intergenerationally, which can adversely affect future home-buyers and income-earners. Against a backdrop of mounting inflationary pressures, a fading Australian dream and eye-watering price growth rates for desirable suburbs and even apartments, the housing market the new generation enters is unfriendly. The government should endeavour to put forward strategic policies such as grants and middle housing infrastructure to curb this. Moreover, there are also some strategies and tips around personal renting and investing that can help you, a hopeful home-buyer, to navigate the market in such a way that you come out on the other side an owner of a property that will provide sufficient capital gains for you to live out your Australian dream.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.