From Iran’s nuclear program to Russia’s invasion of Ukraine, economic sanctions have become one of the most frequently used foreign policy measures to deter unfavourable behaviour of countries since the end of the Cold War. Economic sanctions come in many forms of policies, including trade embargoes, export limitations, and tariff imposition. They aim to induce behavioural change in the target country by restricting the number of available resources and exerting pressure on the country’s economy. Economic sanctions serve as a less economically and politically costly substitute for military intervention. As the cost of sanctions are less observable to the domestic population of the sanctioner, they allow the government to demonstrate their commitment to behavioural norms while minimising the likelihood of domestic backlash. In fact, policymakers often benefit from increased public support when they impose sanctions amid international conflicts (Whang, 2011), which has therefore become a popular policy choice among governments. However, since 1914, only 13 cases out of 200 sets of sanctions achieved their stated goals (Hufbauer et al., 2009) while creating substantial costs for both the sanctioner and the target country’s population. As a result, it is worth questioning whether the effectiveness of economic sanctions can justify the significant costs associated with them, and if they are more than just a symbolic gesture.

To many of us, North Korea and sanctions have become almost synonymous, with a wave of new sanctions placed on the hermit nation seemingly every 6 months. With years of heavy economic sanctioning, the nation is a valuable case study to examine the true effectiveness of the tool to achieve foreign policy objectives. To better understand if sanctions have been effective, this piece will first explore who has placed sanctions on North Korea and for what purpose, how North Korea has reacted to some of them in the short term and examining whether there are alternative strategies more likely to achieve the set goals in the long run.

At their core, the primary purpose of foreign policy action against North Korea are to promote denuclearization in the region, with many major powers weary of allowing the unstable Kim regime to possess weapons of mass destruction, due to it endangering their allies and geopolitical interests in the region. In 2006, the United Nations Security Council (UNSC) adopted a resolution imposing sanctions on North Korea in response to a series of nuclear and missile tests, which prohibits a range of activities including the import and export of many goods and services (DFAT, 2022).

In addition to the UNSC sanctions, several nations and groups aligned with the United States of America have also placed additional sanctions. The main actors behind these sanctions are the US itself, Australia, Japan, South Korea, and the European Union (CFR, 2022). In an ideal world, these sanctions, by making trade and other economic activities excessively difficult for North Korea, would prompt the country to deescalate its nuclear program.

While the treatment of North Korea by US allies has been increasingly hostile, it finds itself a rather stable supporter in China. While China does not outrightly condemn sanctions on North Korea, it has many times demonstrated its willingness to defend the country’s actions on the global stage and skirt sanctions by continuing commercial business activity (Cha, 2012). This is due to the fact that a stable Kim regime in North Korea acts as a bulwark against US influence in the region, and also presents China with the ability to continue making use of North Korea’s plentiful natural resources.

While some outliers exist, it is clear that the global sentiment towards North Korea over the past decades has been largely negative, leading to the question of whether this attitude has been successful in achieving the set goals of denuclearization?

In short, no.

Despite mounting sanctions, North Korea has only continued to ramp up its nuclear program and missiles testing. In fact, the number of missiles launched by North Korean forces have seen a marked shift upwards under Kim Jong Un, compared to his predecessor Kim Jong Il with the especially worrying recent testing of a range of intercontinental ballistic missiles which can potentially also strike targets in the US (BBC, 2021). Furthermore, with denuclearization talks seeing essentially no new progress, and seemingly any progress taken being reset with each new president in the US, the future doesn’t look bright for sanctions as an effective tool.

The reasons for this lack of effectiveness can be boiled down to two key points.

On one hand, the Kim regime in North Korea in its current condition is like a wild animal trapped in a cage with nowhere to escape. It’s well aware of the fate of other dictatorial regimes that stood against US interests, looking to those like Muammar Gaddafi and Saddam Hussein, and sees nuclear armament as the only deterrent from itself reaching a similar fate. This is best exemplified by North Korean foreign minister Ri Yong-ho in 2012, when he announced that North Korea would not denuclearize until the US removed the “threat”, referring to the US – South Korea alliance and presence of US troops in the region, as well as its protection of South Korea and Japan under its Nuclear umbrella (Revere, 2021). This sums up the mindset of the North Korean regime, where regardless of any hardships it faces from the sanctions, it deems it preferable to the outright threat it sees from the US presence in the region.

On the other hand, one could argue that the sanctions placed on North Korea are severely handicapped by China, and more recently Russia’s flouting of the set rules. China in particular accounted for more than 90% of pre pandemic trade with North Korea (Yeo, 2022). A UN panel of exports report in 2021 expressed severe concern in sanctions monitoring and enforcement, particularly by China, which negates the point of placing sanctions on the nation (Beau and Haggard, 2021). In addition, China’s representative in the UNSC proclaimed that the sanctions will not resolve the North Korean issue, claiming they are “inhumane” which was a sentiment echoed by Russia, who also voted against a condemnation of a recent round of ballistic missiles testing in 2022 (UNSC, 2022). With Russia’s relations with the west continuing to sour due to its invasion of Ukraine, it’s unlikely that Russia will back any US led sanction efforts in the near future, further reducing the effectiveness of sanctions placed on North Korea.

Ultimately, this discussion begs the question of what the long-term outlook of these sanctions are, and what would be the best course of action going forward. Firstly, it needs to be accepted that sanctions on North Korea will never be effective without the complete backing of China and Russia, which is an unlikely outcome given the obvious political motivations of all parties involved in the area. Furthermore, the idea of complete denuclearization is also becoming a more and more distant dream with each passing year. Given these conditions, and the highly unlikely potential for a united front against North Korea in the near future, true progress may require a resetting of expectations for talks with the Kim regime. This appears to be the strategy of the Kim regime, looking to shift commitments away from actual denuclearization to higher levels of monitoring and control, in exchange for sanction relief (Revere, 2021). While this is far from an ideal resolution, if the US and its allies truly want to push for progress in talks, it may need to change its lens of a perfect outcome and be willing to expect a reality where North Korea becomes a permanent nuclear power. Alternatively, the US will need to work closely with China to find an agreement deemed feasible, to introduce the possibility of China also aligning with the US and applying true pressure on North Korea. However, with the disastrous political implications of appearing weak on the global stage, it’s possible that no country will be willing to acquiesce, and the North Korean crisis will remain in a standstill for years to come.

In wake of the Russian annexation of Crimea in February 2014, nations across the globe including powerhouses such as the United States of America and countries in the European Union imposed economic and financial sanctions targeted on Russian economic and political elites. These sanctions placed travel bans and restrictions on individuals in addition to asset and banking freezes. In the following months during July and August the sanctions further developed into placing restrictions on trade with respect to military equipment and arms as well as banning transactions on select Russian energy and banking firms (The Moscow Times, 2014).

Since then, with the Russian invasion of Ukraine in February 2022, these sanctions have evolved further in terms of seriousness and are directed directly towards the Russian private wealth, military, and their economic/financial landscape. These sanctions are specifically aimed to cripple the Russian economy. As of March 2022 and estimated $1 trillion in Russian assets have been frozen in a bid to exert extreme economic and financial pressure via inhibiting Russian access to global financial markets (Riley 2022).

One of the key components of the sanctions imposed on Russia in 2022 was limiting Russian banks’ access to SWIFT, which caused suffering to Russian banks through adding a great deal of friction in executing international transactions. Another CAINZ article goes further in-depth into the workings of the SWIFT network and how cutting of access to it impacts a nation. The obstruction of access to the vital network that eases international transactions hinders Russia from fulfilling financial obligations as well as creating difficulties for nations looking to purchase Russian exports thereby, adversely impacting Russia’s international trade sector. Furthermore, this also has negative implications for domestic payments within Russia as major credit card networks such as Mastercard and VISA operate through SWIFT, thereby stalling domestic payments too.

Another cornerstone of the sanctions placed on the Russian oil and gas sector (BBC, 2022). The EU will ban imports of Russian oil brought by sea and the US and UK are banning and phasing out Russian energy imports. Accounting for close to 12% of global oil exports, Russia is a pivotal player in the natural gas and oil markets and the sanctions aim to stifle this revenue stream which made up 45% of their federal budget. For a short period of time, an interesting side effect of the oil and gas trade sanctions was that although sourcing Russian oil and gas was more abrasive, the high prices for it currently assist in Russia funding their invasion of Ukraine.

Foreign exchange markets reacted immediately to the announcements and implementations of the sanctions, and the Russian Rouble began to collapse to all-time lows, a consequence of the historically low demand for the Rouble.

The aforementioned problem regarding credit card networks operating on the SWIFT network which Russia was barred from, in combination with the expected collapse of the Rouble, caused bank runs to occur in Russia around late February, a sign that unambiguously no healthy economy should be producing. Furthermore, there were closures in the Russian stock market were enacted since the end of February for a close to a month in order to prevent a then imminent crash (Turak, 2022). Russian debt markets also took a hit with the nation’s credit risk soaring as “credit swaps [signalled an] 87% chance of default within 5 years”. This held especially true in the banking sector as well as Russia’s currency and sovereign risk as shown by the EIU below. As of April, Russia has also been rated as NR with a n/a outlook by all three S&P, Moody’s and Fitch demonstrating the high debt risk Russia is currently embodying (Benitez and Ramnarayan, 2022).

In response to the collapsing Rouble, the Central Bank of Russia aggressively raised rates to counteract this fall in a bid to increase demand for the Rouble via higher rates increasing capital inflow into Russia, which have been progressively lowered since April this year. This potentially suggests that the ramifications of the sanctions placed on Russia have not had the short-medium term impact that most Western nations were hoping for. This decrease in interest rates is also in line with the subsequent recovery of the Rouble which is now back at pre-invasion levels despite the historically strong USD.

Moreover, the sanctions on Russian oil and gas exports placed Russia in a bad negotiating position to settle on a price with countries that have not placed sanctions on Russia. India and China in particular took advantage of Russia’s bad position and negotiated for prices that were in Russia’s perspective, suboptimal, whereupon both have substantially increased their Russian oil importations. However, even now India is considering a price cap on Russian oil imports following a proposal by Western nations, but it is unknown whether it will come into fruition as of right now (Verma and Narayan, 2022).

Clearly, the immediate reaction to the sanctions across Russia were those of distress and alarm with financial and economic markets experiencing almost instantaneous withdrawals of massive amounts of capital. With respect to the Russian oil and gas sector, although Western nations attempt to wean themselves off of this (currently) essential resource, other nations have come to take advantage of Russia’s unfavourable trading position which has meant that the impact on Russia’s exports were less than hoped for.

Ultimately, to assess the efficacy of the sanctions placed on Russia, it is vital to review the key economic indicators that describe the healthiness of the Russian economy. There is also grounded notion to compare the forecasted indicators of the Russian economy to the realised impact that the sanctions actually had to gauge how accurate predictions were. Clearly, this analysis is not fraught in rigor because no attempt in establishing causality has been made. Nevertheless, it may be interesting to see some sense of how the situation itself played out in reality versus predictions at the onset of the sanctions.

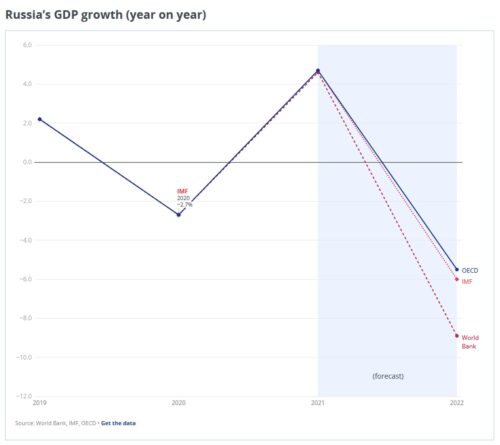

The forecasts below paint a stark picture for the future of Russia’s economy; a tanking GDP growth rate and trade sector and sky-rocketing inflation. The realisations of these variables so far have seen a slightly less bleak impact.

Despite numerous research papers that have been published over the past few decades with the aim of assessing the effectiveness of sanctions and understanding which factors lead to successful cases, the conclusions drawn from research vary significantly across studies. From a game theory perspective, Hovi et al. (2005) suggests that if the target refuses to comply when sanctions are threatened, it usually indicates that they do not intend to yield when sanctions are imposed either, resulting in a high fail rate of imposed sanctions. Haass (1998) argues that targeted sanctions, which focus on penalising individuals, firms or specific sectors of the target economy that are responsible for the offending behaviour, is the more cost-efficient type of sanctions. Target sanctions minimises the jeopardisation of bilateral relationship with the target country and create less collateral damage to the target’s population compared to comprehensive sanctions. As one of the most comprehensive sanctions in history, when the trade embargo was imposed on Iraq in the 1990s, the monthly price of food supply for a family increased 250-fold over the first five years (Hoskins, 1997) and caused significant financial distress among citizens. In addition, the nature of economic sanctions creates scarcity of goods, which tend to result in the emergence of transactional smuggling networks and black-market activities (Drezner, 2011). Due to concerns of these negative externalities, targeted sanctions have become the norm since the 1990s, aiming to deliver more precise policies that focus on and minimise costs on the target country’s population. However, Drezner (2011) suggests that comprehensive sanctions are essential to coerce behavioural change despite the potential negative externalities. It is argued that targeted sanctions are not powerful enough to exert pressure on the target, and their lower costs means that policymakers can be tempted to impose them indefinitely for domestic political interests even when these sanctions are not contributing to their initial foreign policy goals.

Continuing the discussion on the cost of economic sanctions, research has also shown that economic sanctions are more likely to be successful in obtaining concession from the target if they are supported by the target’s major trading partners. On average, in cases of successful economic sanctions, the sanctioner accounts for 28 percent of the target’s trades, yet only 19 percent in fail cases (Elliott, 1997). This implies that effective sanctions are also likely to be more costly to the sanctioner, as they need to forego exports with close trading partners. The cost on the sanctioner not only includes the reduction in potential trade flows, but the loss of domestic employment opportunities in the export sector as well. In addition, as exporters of the sanctioning country are deemed as unreliable suppliers (Elliott, 1997), the impact of export limitations on the sanctioner’s economy can linger even after restrictions have been lifted.

Economic sanctions have the potential of impacting multiple dimensions of both the sanctioning and target countries, and their effectiveness can highly depend on the unique factors involved in each individual case. The lack of consensus among researchers in the effectiveness of economic sanctions demonstrates the complexity of this foreign policy tool, and highlights the importance of discretion among policymakers when planning and implementing economic sanctions in order to ensure that the they achieve expected impacts while being responsible for potential economic implications.

Beau, S., & Haggard, S. (2021). North Korean Sanctions Evasion: The UN Panel of Experts Report – Korea Economic Institute of America. Korea Economic Institute of America. Retrieved 19 October 2022, from https://keia.org/the-peninsula/north-korean-sanctions-evasion-the-un-panel-of-experts-report/.

BBC. (2022). What are the sanctions on Russia and are they hurting its economy? BBC. https://www.bbc.com/news/world-europe-60125659

Benitez, L., and Ramnarayan, A. (2022). Russia’s Credit Risk Surges as Putin’s Demands Renew Default Fears. https://www.bloomberg.com/news/articles/2022-03-24/russia-credit-risk-surges-as-putin-s-demands-renew-default-fears#:~:text=credit%20swaps%20signal%2087%25%20chance%20of%20default%20within%20five%20years

Cha, V. (2012). The Impossible State: North Korea, Past and Future. Random House.

Democratic People’s Republic of Korea (North Korea) sanctions regime. (2022). https://www.dfat.gov.au/international-relations/security/sanctions/sanctions-regimes/democratic-peoples-republic-korea-sanctions-regime.

Drezner, D. W. (2011). Sanctions Sometimes Smart: Targeted Sanctions in Theory and Practice. International Studies Review, 13(1), 96–108. http://www.jstor.org/stable/23016144

Elliott, K. A. (1997). Evidence on the Costs and Benefits of Economic Sanctions. Peterson Institute for International Economics. https://www.piie.com/commentary/testimonies/evidence-costs-and-benefits-economic-sanctions

Haass, R. N. (1998). Economic Sanctions: Too Much of a Bad Thing. Brookings. https://www.brookings.edu/research/economic-sanctions-too-much-of-a-bad-thing/

Hoskins, E. (1997) Humanitarian Impacts of Sanctions and War in Iraq. Political Gain and Civilian Pain. Rowman & Littlefield.

Hovi, J., Huseby, R., Sprinz, D. F. (2005). When Do (Imposed) Economic Sanctions Work? World Politics, 57(4), 479–499. http://www.jstor.org/stable/40060115

Hufbauer, G. C., Schott, J. J., Elliott, K. A., Oegg, B. (2009). Economic Sanctions Reconsidered. Peterson Institute for International Economics. https://www.piie.com/bookstore/economic-sanctions-reconsidered-3rd-edition-paper

North Korea: What missiles does it have?. (2022). https://www.bbc.com/news/world-asia-41174689.

Revere, E. (2022). North Korea’s new nuclear gambit and the fate of denuclearization. Brookings. https://www.brookings.edu/blog/order-from-chaos/2021/03/26/north-koreas-new-nuclear-gambit-and-the-fate-of-denuclearization/.

Riley, C. (2022). The West’s $1 trillion bid to collapse Russia’s economy. CNN. https://edition.cnn.com/2022/03/01/business/russia-economy-sanctions/index.html

Security Council Fails to Adopt Resolution Tightening Sanctions Regime in Democratic People’s Republic of Korea, as Two Members Wield Veto | UN Press. Press.un.org. (2022). https://press.un.org/en/2022/sc14911.doc.htm.

The Moscow Times. (2014). Third Wave of Sanctions Slams Russian Stocks. The Moscow Times. https://www.themoscowtimes.com/2014/07/17/third-wave-of-sanctions-slams-russian-stocks-a37409

Turak, N. (2022). Long lines at Russia’s ATMs as bank run begins — with more pain to come, analysts say. CNBC. https://www.cnbc.com/2022/02/28/long-lines-at-russias-atms-as-bank-run-begins-ruble-hit-by-sanctions.html

Verma, N., and Narayan, M. (2022). India to examine Russia oil price cap; its refiners line up Dec crude buys. Reuters. https://www.reuters.com/business/energy/india-examine-price-cap-proposal-russian-crude-2022-10-19/

Whang, T. (2011). Playing to the Home Crowd? Symbolic Use of Economic Sanctions in the United States. International Studies Quarterly, 55(3), 787–801. http://www.jstor.org/stable/23020066

What to Know About Sanctions on North Korea. Council on Foreign Relations. (2022). https://www.cfr.org/backgrounder/north-korea-sanctions-un-nuclear-weapons.

Yeo, A. (2022). Why further sanctions against North Korea could be tough to add. Brookings. https://www.brookings.edu/blog/order-from-chaos/2022/07/08/why-further-sanctions-against-north-korea-could-be-tough-to-add/.

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.