Australia’s data centre industry is rapidly growing, driven by advancements in artificial intelligence (AI) technology. To illustrate this surge, generative AI tools like ChatGPT accumulated 6 million subscribers in just six days. Data centres serve to store the unprecedented amounts of data needed to power complex AI machinery. As a result, Australia’s data centre industry is forecasted to nearly double in value, growing from AUD $23 billion to AU $40 billion by 2028. Sydney is the epicentre of this boom as the fastest-growing data centre market in the Asia Pacific region, adding 177 megawatts (MW) of operational capacity in the first half of 2024. The average size of land purchased for data centres in Australia has exponentially risen from 1.3 hectares in 2018 to 15.7 hectares in 2024. The increased demand for data centres presents numerous opportunities for the Australian economy to flourish, but their impacts on both cybersecurity and the environment have been questioned by many.

Economic Benefits of Data Centres

As AI companies like OpenAI expand their operations, data centres have become a hot commodity for investors globally. Data centres are critical for data processing, storage and strenuous computational services. Akin to the development of the electrical grid for electricity, data centres are a foundational component for the future of AI’s growth. The transformative impact of data centres is captured by the staggering global investment in data centres totalling $36 billion in 2023.

Fuelled by the widespread use in schools and workplaces to enhance work, creativity and learning, AI models, such as OpenAI’s ChatGPT, have made data centres extremely valuable. As such, data centres have attracted the attention of institutional investors. Exemplary to this is Blackstone’s acquisition of AirTrunk for US$16.1 billion. The hyperscale data centre specialist, AirTrunk, has more than 800 megawatts of capacity and owns land to support over 1 gigawatt. Accordingly, its capabilities are aimed at handling massive workloads by easing the power-hungry computational strain of AI and cloud computing. With endeavours to become a leader in owning and developing infrastructure that can support AI, Blackstone made the largest investment in the Asia-Pacific region.

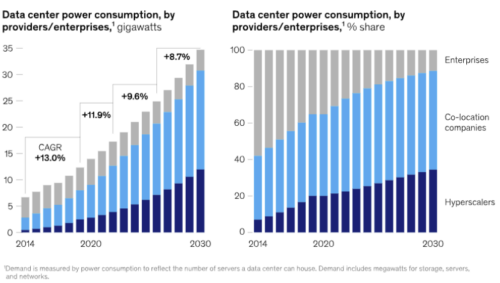

Figure 1. Data centre demand in the US

Figure 1. Data centre demand in the US

Source: McKinsey & Company https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/investing-in-the-rising-data-center-economy

As a dynamic sector, much of the development potential for data centres is not entirely captured, with numerous opportunities to take advantage of the increasing use of cloud computing and generative AI. Blackstone expects about $2 trillion to be spent in building new data centres worldwide within the next five years which is reinforced by predictions that the data centre demand in the United States of America (USA) will grow by 10% annually until 2030. Furthermore, data centre-related jobs have grown by 20% in the USA between 2017 and 2021 to 3.5 million. The predictions for the foreseeable future showcase a bright future in the data centre industry with an abundance of employment and investment opportunities.

Cybersecurity Implications of Australia’s Data Centres

As Australia’s data centre industry rapidly expands to meet the growing demand for AI and cloud services, cybersecurity would naturally become a critical issue that, if mishandled, could jeopardise the benefits of this endeavour. New data centres, such as Macquarie’s proposed IC3 Superwest, have received significant government investments to expand its cybersecurity and cryptography workforce to combat digital threats. Moreover, as humans increasingly engage with AI, data centres would house increasing amounts of personal data that make them vulnerable to cyberattacks like ransomware, AI-driven phishing, and social engineering tactics. Consequently, data centres are expected to implement advanced security frameworks that can function autonomously. AI-powered InfoSec models have become a popular tool to secure data centres, verifying user identities and scrutinising each network component. These systems are essential in defending against insider threats and sophisticated cyberattacks.

Furthermore, beyond threats to data, machine learning has been increasingly misused. The Australian government has acknowledged these risks by emphasising cybersecurity as part of its critical technology framework, which details the regulations the Australian Government believes would protect Australia’s national interests within the digital world. However, these visions for a threat-free future are bound by a large shortage of skilled cybersecurity professionals and the need for stricter compliance measures, such as enhanced encryption and data privacy protocols. Therefore, addressing these issues is essential to securing the security of Australia’s data infrastructure.

Environmental and Energy Network Concerns

As institutional investors and big tech firms eye the data centre industry, there are rising concerns around the high energy consumption of the centres and their environmental impact. The energy intensive computing and cooling systems are the main contributors to high power consumption, with estimates that one large data centre consumes the same amount of energy as 50,000 homes. As Microsoft, Amazon and Macquarie Technology Group make billion-dollar pledges to invest in Australia’s data centre industry, many ask if Australia can handle it.

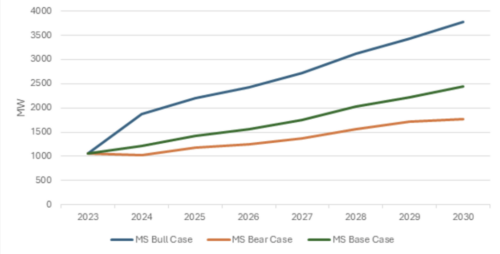

Estimates from Morgan Stanley suggest that data centres currently use five percent (1,050 MW) of the electricity on Australia’s power grid, rising to eight percent (2,500 MW) by 2030.

Figure 2. Data Centre Forecast (Uninterruptible Power Supply)

Source: Morgan Stanley Research

Though some predictions suggest a much higher level of energy consumption in the future, a concern in countries like Ireland, whose data centres currently consume 18% of the nation’s power. Singapore has put the breaks on data centre developments. As Australia transitions to clean energy, federal and state governments need to ensure they manage the growing energy consumption of data centres.

While the main environmental impact comes from how this energy is produced, there are also construction and infrastructure impacts too. A majority of hyperscale data centres have commitments to net-zero emissions targets, but whether they keep to this or not is yet to be seen. Morgan Stanley still predicts high CO2 emissions from the data centre industry.

Another resource that should be monitored is water, a component of cooling systems. Estimates suggest data centres consume around 2 gigalitres of water a year for cooling, though this is significantly more manageable owing to Australia’s desalination plants.

Conclusion

Data centres are at the forefront of a rapidly changing digital economy. They present sizable economic benefits due to their key role in data processing, storage and computation, positioning them as profitable investments by institutional investors. Due to the increased usage of data and AI in everyday lives, cybersecurity has become a critical issue in data centres. The proliferating amount of personal data in these centres sows the seed of potential cyberattacks. Coupled with the potential misuse of machine learning to attack digital infrastructure, comprehensive contingencies and countermeasures are required. A pertinent issue is the environmental sustainability of data centres as a result of concerns about the carbon footprint of their energy usage and reliance on water. At the rate of AI development and the growing need for cloud computing, data centres will continue to be a fundamental infrastructure to support new technologies.

REFERENCES

Abdul Khader Aslam. (2024, June 18). Protecting data centres against emerging cybersecurity threats. SecurityBrief Australia. https://securitybrief.com.au/story/protecting-data-centres-against-emerging-cybersecurity-threats

CBRE. (2024). Data Center Growth Has Economic Ripple Effects. Cbre.com. https://www.cbre.com/insights/briefs/data-center-growth-has-economic-ripple-effects

Condie, S. (2024, September 4). Blackstone Buys Australian Data-Center Operator for $16.1 Billion. WSJ; The Wall Street Journal. https://www.wsj.com/business/deals/blackstone-buys-australian-data-center-operator-for-16-1-billion-55cdb48b

CRN Australia. (2024, September 9). Asset manager Blackstone-led consortium buys AirTrunk for A$24 billion. CRN Australia. https://www.crn.com.au/news/asset-manager-blackstone-led-consortium-buys-airtrunk-for-a24-billion-611443

Data centres: A 24hr power source? (2023). Australian Energy Council.

https://www.energycouncil.com.au/analysis/data-centres-a-24hr-power-source/

Data Centres and Energy Demand – What’s Needed? (2024, Jun 27). Australian Energy Council. https://www.energycouncil.com.au/analysis/data-centres-and-energy-demand-what-s-needed/

Jalili, S. (2024, October 2). Australia’s data centre investable universe set to double in four years – CBRE. Commo. https://www.commo.com.au/news/2024/10/02/australia%E2%80%99s-data-centre-investable-universe-set-double-four-years-cbre/1727830600

Jones, R., Fiet, J., & Law, D. (2022, May 29). $22bn invested in data centres so far in 2024 with the United States and Europe attracting highest levels of investment | News | About Us | Linklaters. Www.linklaters.com. https://www.linklaters.com/en/about-us/news-and-deals/news/2024/may/us22bn-invested-in-data-centres-so-far-in-2024

Macdonald, A. (2024, May 28). How much will hungry data centres take out of the power grid? Australian Financial Review. https://www.afr.com/chanticleer/how-much-will-hungry-data-centres-take-out-of-the-power-grid-20240528-p5jh5z

Mckinsey. (2023, January 17). Why invest in the data center economy | McKinsey. Www.mckinsey.com. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/investing-in-the-rising-data-center-economy

Milmo, D. (2024, October 2). OpenAI raises $6.6bn in funding, is valued at $157bn. The Guardian; The Guardian. https://www.theguardian.com/technology/2024/oct/02/openai-raises-66bn-in-funding-is-valued-at-157bn

Moss , S. (2024, July 24). Blackstone has $70bn in prospective data center pipeline, on top of $55bn portfolio. Datacenterdynamics.com. https://www.datacenterdynamics.com/en/news/blackstone-has-70bn-in-prospective-data-center-pipeline-on-top-of-55bn-portfolio/

Parfitt, N. (2024, July 23). W.Media. W.Media. https://w.media/australias-cyber-security-minister-breaks-ground-at-macquarie-data-centres-new-ai-and-cloud-facility/

Powering the Growth of Generative AI. (2024, July 1). Morgan Stanley Australia. https://www.morganstanley.com.au/events-programs/australia-summit/powering-the-growth-of-genai

Property Australia. (2024, October). Sydney fastest growing data centre region – Property Council Australia. Property Council Australia; Agend. https://www.propertycouncil.com.au/property-australia/sydney-fastest-growing-data-centre-region

Schlesinger, L. (2023, September 11). Data centres set to grow to “unheard of” sizes. Australian Financial Review. https://www.afr.com/property/commercial/data-centres-in-the-hundreds-of-megawatts-coming-thanks-to-ai-20230911-p5e3p7

Turner, J. (2024, February 26). The cyber lessons Australia still has not learnt. Australian Financial Review. https://www.afr.com/technology/the-cyber-lessons-australia-still-hasn-t-learned-20240223-p5f7hb

The CAINZ Digest is published by CAINZ, a student society affiliated with the Faculty of Business at the University of Melbourne. Opinions published are not necessarily those of the publishers, printers or editors. CAINZ and the University of Melbourne do not accept any responsibility for the accuracy of information contained in the publication.